Expectedly, the “reciprocal” tariff deadline has been extended for the second time; now pushed to August 3. Separately, the U.S. president announced a 50% tariff on copper imports, likely aiming to incentivize domestic mining investment — a theme we explored in our recent piece on Nordic mining OEMs. In addition, and true to form, the President unveiled a 30% tariff on imported goods from the EU over the weekend.

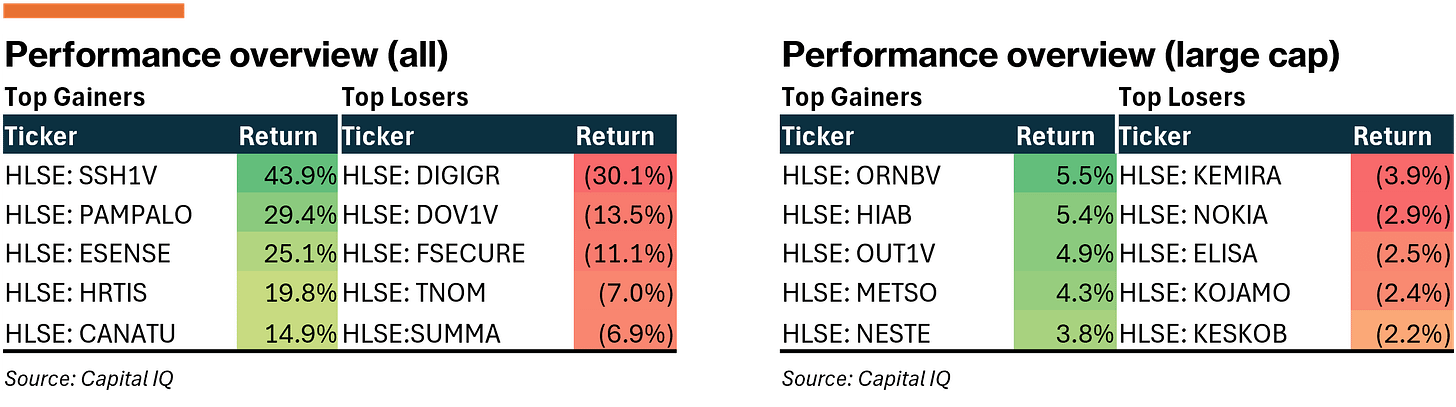

While most major indices have returned to all-time highs, the Nordics remain a relative laggard (except for Norway), ending the week flat (+0.1%).

With the Q2-2025 earnings season officially kicked off, the coming weeks will reveal whether the regional underperformance is justified. Early signals suggest headwinds are real: several industrials have already revised their FY guides lower, citing FX drag from a weaker USD and tariff-related uncertainty.

Denmark

Shares in Copenhagen mirrored the wider Nordic sentiment, with the all-share (-0.5%) and large-cap (+0.2%) index both treading water.

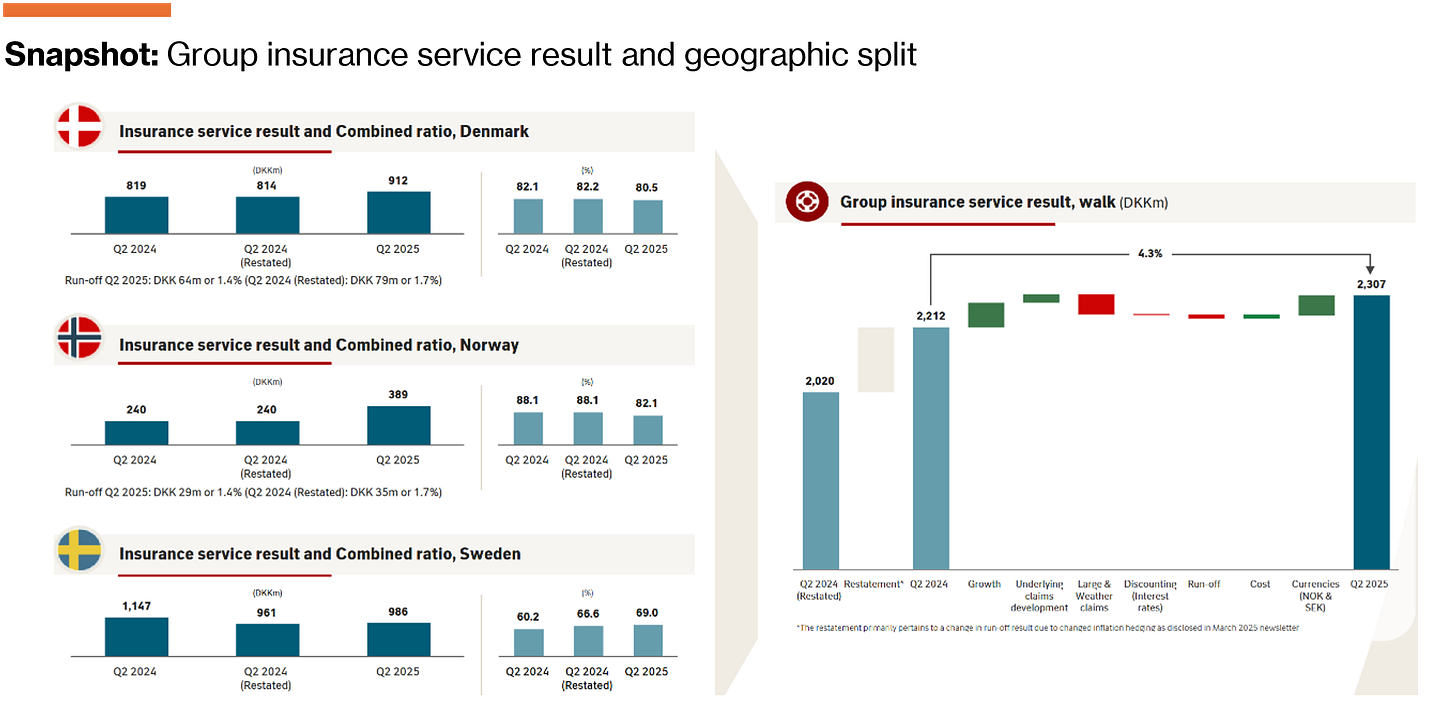

Tryg (CPSE:TRYG) delivered another solid quarter with Q2-2025 PBT of DKK 2,035m, 5% ahead of consensus. Premiums earned came in at DKK 10,120m (cons. DKK 10,009m), with local currency growth of 4.0% YoY (Q1: 3.7%). The insurance service result was DKK 2,307m (cons. DKK 2,191m), supported by benign claims trends. Weather claims (DKK 60m) and large claims (DKK 134m) were both below expectations.

The combined ratio improved to 77.2% (cons. 78.1%), driven by a ~30bp YoY improvement in the underlying claims ratio and continued progress in Norway (CR: 82.1%, ~6pp YoY improvement). Investment income landed at DKK 110m (cons. DKK 116m). DPS of DKK 2.05 was in line with expectations. All in, a stable quarter with slight positive read-through for 2026–27 EPS. The DCCA investigation remains an open item, but management’s remains confident in their ability to overcome any adverse outcomes.

Relevant news:

GreenMobility (CPSE:GREENM) raised its 2025 guidance after a stronger-than-expected H1. It now expects revenue growth of 10-13% (prev. 7-13%) and EBITDA growth of 25-40% (prev. 20-40%). Preliminary H1 figures show revenue of DKK 74.2m (+29% YoY) and EBITDA of DKK 24.1m (+76% YoY). Full H1 report to be released on August 14.

Decideact (CPSE:ACT) filed for bankruptcy following a failed sale to US-based Nixxy and unsuccessful financing attempts. The Bornholm-based SaaS firm, listed on First North since 2020, had ARR of DKK 6.1m in 2024 but ran an operating loss of DKK 6.5m and laid off all staff in March.

SP Group (CPSE:SPG) issued a profit warning after Q2-2025 revenue fell 10.7% YoY to DKK 680.6m (LY: DKK 762.2m) and PBT dropped 30.6% to DKK 63.6m (LY: DKK 91.6m). The downgrade follows delayed customer projects amid geopolitical uncertainty and supply chain disruptions. The updated guide points to FY25 revenue growth of -3% to +3% (prev. +3-10%) but maintains its EBITDA margin guidance of 19-21%.

Novo Nordisk (CPSE:NOVO B) submitted an EU application for a higher 7.2 mg dose of Wegovy, citing strong Phase III data from “Step Up” trials showing avg. 21% weight loss and +25% in one-third of patients. Safety profile was comparable to the current 2.4 mg formulation.

Bavarian Nordic (CPSE:BAVA) received a repeat order worth DKK >200m from an unnamed European country for its MVA-BN smallpox/mpox vaccine. The deal is supposedly part of a wider European strategy to secure public preparedness efforts amid rising geopolitical risks. The company is among our three Nordic pharma-picks, outlined on the back of Trump’s tariff scare:

Sweden

Performance in Stockholm was bifurcated, with real estate and telecoms dragging on returns, while financials and industrials provided support. Both the all-share index (+0.5%) and large cap index (+0.6%) closed the week modestly higher.

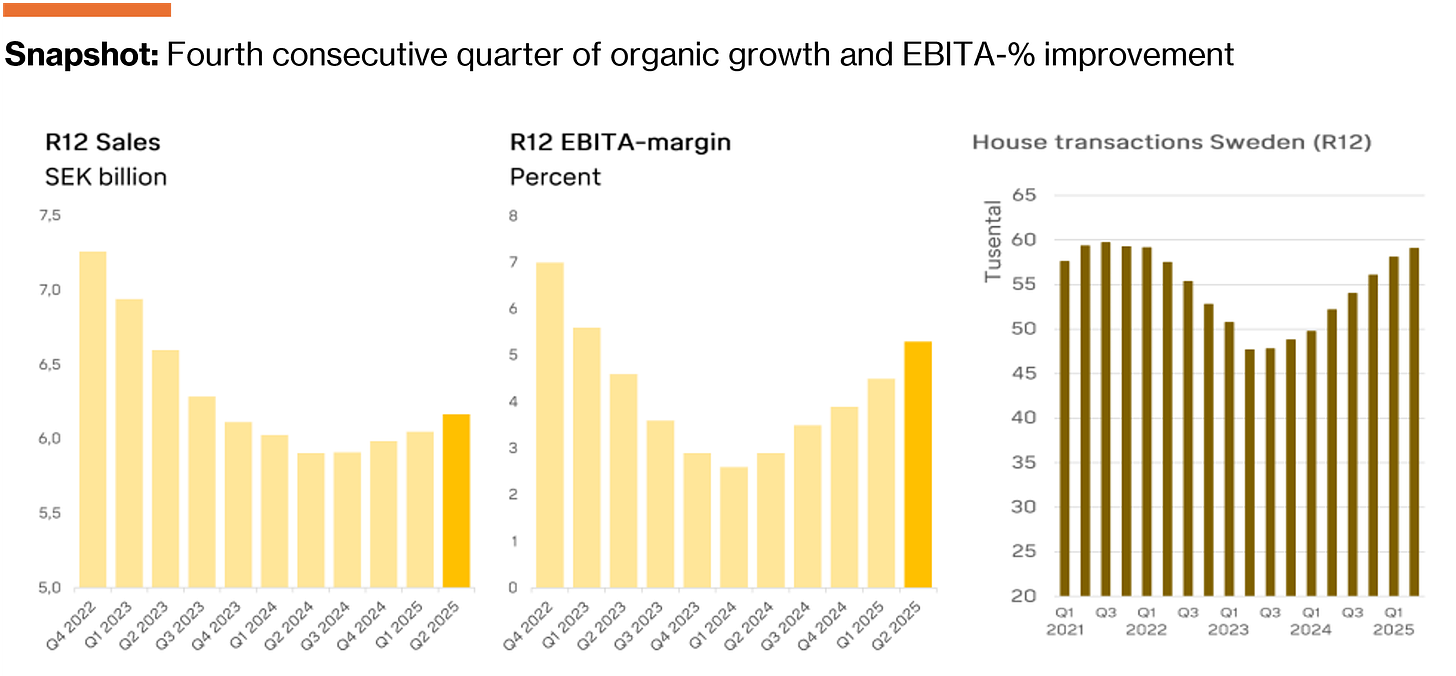

Byggmax delivered a strong Q2-2025, supported by robust seasonal demand and operational improvements. Net sales came in at SEK 2,199m (+5.6% YoY), with comparable sales growth of 7.3% YoY. EBITA rose to SEK 223m (LY: SEK 170m), aided by higher GM-% from improved inventory management, store network- and e-com logistics efficiencies. Net income reached SEK 161m (LY: SEK 108m), translating to EPS of SEK 2.75 (LY: SEK 1.85).

Management cited continued strong customer flow during the high season and improved execution in store refurbishment and logistics, setting the scene for strong profitability rebound as operating leverage kicks in amid demand recovery.

Relevant news:

EQT (OM:EQT) was lifted by a series of buy recommendations from various banks

Industrivärden (OM:INDU C) reported Q2-2025 NAV/share of SEK 384, with SEK 1.45bn deployed across Sandvik (OM:SAND), Volvo (OM:VOLV), SCA, (OM;:SCA B) and Essity (OM:ESSITY B) — all existing holdings. The share trades at a ~13% discount to NAV.

Kinnevik (OM:KINV B) reported Q2-2025 NAV/share of SEK 133 (+2% QoQ), in line with expectations. Portfolio value rose 3% (+5% in CC), driven by operational strength and modest multiple expansion. SEK 860m was deployed, incl. SEK 333m in Tandem Health and SEK 335m in an undisclosed biotech name. The share trades at a ~30% discount to NAV, with continued valuation support and upside optionality from future IPOs.

Hexatronic (OM:HTRO) headline figures far from expectations. Q2-2025 sales came in at 1,906m (-6% vs. cons) with EBITA of SEK 169m (-26% vs. cons). The shortfall was driven by weaker FTTH demand and added price pressure in Fiber Solutions. Notably, the short interest has climbed to 12.1% from 9.1% start of the week. The company is set to report H1 figures on July 14.

Altor has re-entered Dustin (OM:DUST), acquiring 9.5m shares (~0.7% of capital) following the IT distributor’s SEK 1.27bn rights issue. The move comes after Altor — which took the company public in 2015 — sold its prior 1.3% stake (5.7m shares) ahead of the offering.

Finland

The Finnish market escaped the week with the best regional performance, with the all-share and large-cap index moving in locksteps, ending the week up +0.9%. That said, the week did feature a series of — to an extent — expected profit warnings, incl. Metsä (HLSE:METS B) and Kemira (HLSE:KEMIRA).

Admicom (HLSE:ADMCM) posted a muted Q2-2025 with revenue at EUR 9.7m (cons. EUR 9.8m; +2.1% YoY) and adj. EBITDA at EUR 3.1m (cons. EUR 3.3m; LY EUR 3.6m). EPS fell to EUR 0.26 (cons. EUR 0.34; LY EUR 0.38). The top-line was impacted by lower equalization invoicing, which the company is transitioning away from in favor of more predictable, recurring billing. ARR grew 6% YoY to EUR 35.7m but was flat QoQ.

Management noted headwinds from bankruptcy- and consolidation-related churn, offset by a cohort of new (but smaller) customers. With profitability weaker and demand visibility still soft, the unchanged FY guide (ARR +8–14%, revenue +6–11%, adj. EBITDA margin 31–36%) now looks increasingly back-end loaded.

Relevant news:

Endomines (HLSE:PAMPALO) acquired Power Mining’s Pampalo gold mine for EUR 2.55m. The deal includes underground equipment and inventory, and is expected to lower gold production costs by EUR 90–120/oz from 2026 as Endomines consolidates operations and ramps up output.

SSH Communications (HLSE:SSH1V) received a EUR ~160k order for its NQX Quantum Safe encryption solution from a European defense organization. The deal comes just one week after Italian company, Leonardo (BIT:LDO) acquired a 24.6% stake in the company.

Enersense (HLSE:ESENSE) will divest its marine industry unit to Davie, part of UK-based Inocea Group, for EUR 7.5m (EUR 5m at closing, EUR 2.5m deferred). The deal, expected to close in Q3-2025, concludes a trio of strategic exits from non-core units, as the company’s refocuses on core energy and infrastructure services.

Kemira (HLSE:KEMIRA) has revised its 2025 guidance due to continued weak demand in packaging and pulp and FX headwinds. It now expects net sales of EUR 2.7–2.95bn (prev. EUR 2.8–3.2bn) and EBITDA of EUR 510–580m (prev. EUR 540–640m). Preliminary Q2-2025 figures show sales of EUR 693.4m (LY: EUR 733.4m) and EBITDA of EUR 131.8m (LY: EUR 140.5m). Full H1 report due July 18.

Fifax (HLSE:FIFAX) filed for bankruptcy after failing to secure financing to complete its restructuring process. The appointed liquidator deemed continued proceedings unviable, a view supported by the board.

Canatu (HLSE:CANATU) announced that a reactor delivered to a semiconductor customer passed testing, marking a key milestone. The company listed via a reverse merger with Lifeline SPAC in September 2024.

Norway

Busy week in Norway with a earnings surprises in both directions. The all-share (+0.2%) and large-cap (-0.2%) index closing the week roughly flat.

The insurance sector stood out in Norway this week, with Protector (OB:PROT), Storebrand (OB:STB), and Gjensidige (OB:GJF) all delivering strong Q2-2025 prints. Particularly noteworthy was GJF, which posted a broad-based beat with insurance revenue of NOK 10,493m (cons. NOK 10,307m), underwriting result of NOK 2,200m (cons. NOK 1,784m), and net investment income of NOK 1,102m (cons. NOK 910m). The group combined ratio improved to 79.0% (cons. 82.7%). All 2025 targets were reiterated, and H1-2025 CR-% of 82.8% suggests upward pressure on FY estimates if momentum holds.

Norwegian Air Shuttle (OB:NAS) reported Q2-2025 revenue of NOK 10.3bn (cons. NOK ~10.2bn; LY: NOK 9.4bn) and PBT of NOK 1.1bn (cons. NOK 890m; LY: NOK 477m). EBIT was NOK 1.25bn — the second-highest Q2 in company history — with strong seasonal demand, improved load factors (85.2% for Norwegian, 73.9% for Widerøe) and ongoing efficiency gains. Norwegian declared its first dividend post-restructuring (NOK 0.90/share; ~NOK 950m payout).

The company’s strategic focus now centers on extracting further synergies from Widerøe through integrated networks, IT platforms, and loyalty programs, alongside cost savings under Program X (targeting NOK 1bn in savings by 2026). Management flagged strong booking momentum into H2 and noted positive macro tailwinds with falling fuel prices, a stronger NOK, and easing rates. The company now trades at ~8.0x 2026E P/E, a 20% discount to global LCC peers.

Relevant news:

Telenor (OB:TEL) has agreed to acquire EQT-owned (OM:EQT) GlobalConnect’s Norwegian B2C fiber business for NOK 6bn. The deal adds ~140,000 customer relationships, infrastructure, and local operations.

Airthings (OB:AIRX) has ended sale talks of select business units with Switzerland’s Zehnder Group over execution and timing misalignment, and now aims to finalize an asset deal with Firda (29% stake) by August. Firda has completed due diligence.

Argeo (OB:ARGEO) has paused bankruptcy proceedings after receiving interest from a major industrial player. Argeo had filed for bankruptcy after failing to secure sufficient work despite a NOK 150m capital raise in Feb-2025.

MPC Container Ships (OB:MPCC) rose after main shareholder MPC Capital increased its stake from ~16.7% to ~20.1%.

Kongsberg Gruppen (OB:KOG) reported Q2-2025 revenue of NOK 13,741m (cons. NOK 14,240m) and adjusted EBITDA of NOK 2,328m (cons. NOK 2,307m), with group margin of 15.8% (cons. 16.2%). EBITDA margin for KDA fell to 17.1% (–2.2pp YoY), while KM’s EBITDA margin declined to 13.3% (–0.8pp YoY), weighed by softer aftermarket growth (+3–7% YoY). Order intake was sound at NOK 9.8bn (KDA) and NOK 7.5bn (KM); but already fully reflected in the share price.

TGS (OB:TGS) issued a weak Q2-2025 trading update with produced revenue of USD 306m (cons. USD 394m), missing expectations due to delays in multi-client licensing and operational issues on contract projects. The company is set to report on July 17.