Patents, Pills, and Protectionism: The Effects of U.S. Tariffs on the Nordic Pharmaceutical Industry

We examined the full universe of profitable Nordic-listed pharmaceutical firms to identify which companies are structurally resilient in the face of U.S. tariffs. In our view, generic providers will likely face greater pressure compared to branded-/proprietary players, given thinner margins and limited pricing power. Having said that, we also remain cautious on certain proprietary-based therapeutic areas — such as obesity — where competition is intensifying.

The WTO Pharma Agreement

To fully grasp the potential impact of tariffs on pharmaceuticals, it's essential to understand the historical context and the framework established by the WTO. In 1994, the U.S. and several major trading partners1 entered into the WTO Pharmaceutical Agreement; a "zero-for-zero" initiative aimed to eliminate tariffs on a broad range of pharmaceutical products and chemical intermediates used in production. The agreement has been reviewed four times since establishment including in 1996, 1998, 2007, and 2010.

On April 02, 2025 (“Liberation Day”) the U.S. administration announced its aggressive stance on tariffs for U.S. imports. Shortly thereafter, the administration granted a 90-day deferral window to engage in bilateral discussions — apart from China for which there is a 145% tariff already in effect at the time of writing. Pharmaceuticals were initially excluded from the tariff list, however, President Trump has been vocal about his intent to address this domain in due course.

“Pharma companies are going to come roaring back, they’re coming back to our country, because if they don’t, they got a big tax to pay. And if they do, I’ll be very happy” - Donald Trump (April 02, 2025)

For now, the can is kicked down the road — and with the 90-day deferral, we deem it unlikely for it to be addressed near-term. In fact, we believe there is a fundamental constraint to the President’s preferences, making it unlikely for a full-scale tariff on Pharmaceuticals:

Globalized supply chain entanglement

The pharmaceutical supply chain is among the most globally integrated of any industry. Active ingredients may be synthesized in China, formulated in Ireland, packaged in Germany, and distribution routed through U.S. logistics hubs. Tariffs applied mid-stream risk creating bottlenecks and compliance burdens that could disrupt production cycles. In the extreme, such disruption raises the probability of drug shortages, transforming a trade policy maneuver into a national health risk. Given the asymmetry between the policy objective and the downside scenario, we deem it a tail risk few (potentially with the exception of Trump himself) would willingly underwrite.

Europe accounts for ~80% of U.S. trade deficit in biopharma

The U.S. biopharmaceutical trade deficit with the European Union has expanded steadily over the past decade, reaching USD 101bn in 2023. The imbalance reflects a structural reliance on European manufacturing capacity for high-value therapies and intermediates. Approximately ~80% of the total U.S. biopharma trade deficit is attributable to European partners. Of that, ~40% originates from Ireland (a hub for formulation and export due to favorable tax and regulatory frameworks), with ~11% from Switzerland, ~9% from Germany, and ~20% from other EU countries — primarily in the Nordics, where a growing CDMO and biotech presence is becoming increasingly relevant.

Rising costs to US consumers

The higher tariff would either squeeze margins or force price increases. Starting with the former, higher operating costs would potentially entail a deteriorating R&D spend — particularly for smaller biotech and generics — which is not in the interest of the U.S. population. On the latter, we believe any incremental cost increase for proprietary therapeutics with limited viable competition would likely get passed to U.S. consumers which contradict Trumps original tariff intent.

A higher tariff on pharmaceutical imports would either compress margins or lead to price increases. In the first case, margin pressure from elevated operating costs could impair R&D budgets — particularly for smaller biotech and generic manufacturers with limited pricing power. This outcome runs counter to U.S. policy goals, as it risks slowing innovation and reducing access to affordable alternatives. In the second case, where pricing power exists — notably in proprietary therapeutics with limited competition — manufacturers are likely to pass on incremental costs to U.S. consumers2. This undermines the original policy rationale behind the tariffs: reducing healthcare costs and improving domestic access.

Reshoring will be slow and costly

Finally, building out FDA-approved manufacturing capacity is a multi-year process, constrained by both capital intensity and regulatory lead times. Facility construction, process validation, and FDA inspection cycles often span several years, particularly for sterile or complex biologic products. As such, we do not believe companies would be able to meaningfully reallocate production in the near term to avoid tariffs. Similarly, the long payoff period weakens the incentive to invest preemptively — especially amid uncertainty around the permanence or scope of the tariff regime.

U.S. Tariffs in the Context of Nordic Pharmaceuticals

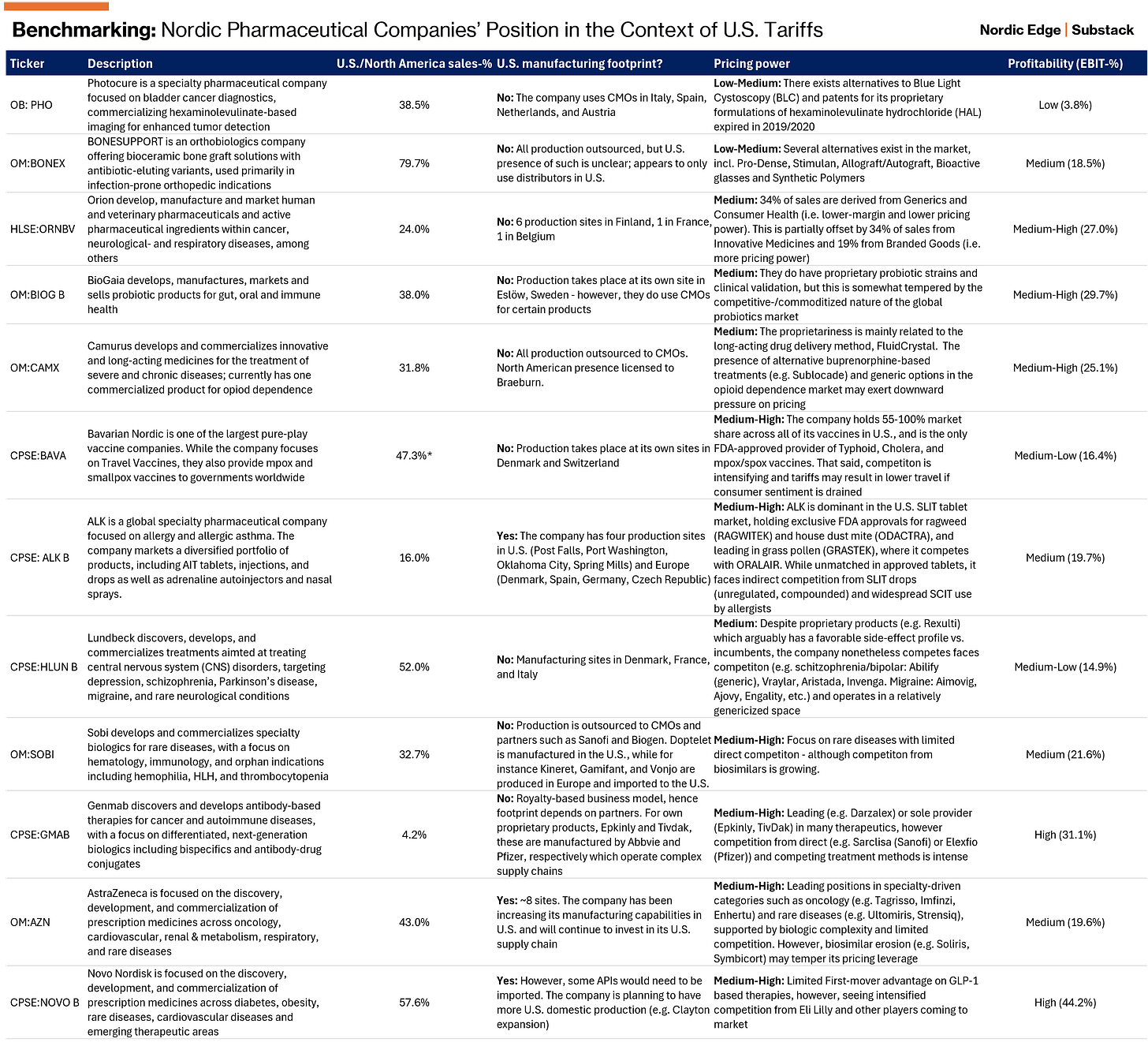

Despite the unlikely outcome of a broad-based tariff on pharmaceuticals (consensus), we believe the following variables will remain key as to gauging the sensitivity toward tariffs: (I) proportion of U.S. sales; (II) U.S. manufacturing footprint; (III) pricing power; and (IV) margin-level and sustainability of such.

We screened the 12 EBIT-positive Nordic-listed companies within the “Pharmaceuticals, Biotechnology and Life Sciences” industry3 and scored them based on their preparedness to withstand the blow. For the avoidance of doubt: We do not assess the pipeline — or any other catalysts that may unlock upside. This is purely a snapshot of the company’s sensitivity toward U.S. tariffs.

Based on the above, we argue the companies best equipped to weather potential repercussions from the U.S. tariffs are:

AstraZeneca (OM:AZN): U.S. presence is supported by robust manufacturing footprint. Dominant position across key therapeutics drives pricing power

Swedish Orphan Biovitrum (OM:SOBI): Partnership-based GTM strategy and focus on rare diseases with limited viable alternatives

GenMab (CPSE:GMAB): Partnership-based GTM strategy and focus on niche therapeutics with limited direct alternatives. That said, overhanging risks from lawsuit with Abbvie may dampen upside

ALK Abelló (CPSE:ALK): Low dependency on U.S. sales. Leader within its niche, but not entirely shielded from competition from substitute treatment types

Novo Nordisk (CPSE:NOVO B): Decent U.S. production presence albeit not to the same extent as Eli Lilly (NYSE:LLY). Similarly, competitive pressures are mounting

Bavarian Nordic (CPSE:BAVA): Dominant position with no or limited viable alternatives

Our top picks include Swedish Orphan Biovitrum (OM:SOBI), AstraZeneca (OM:AZN), and Bavarian Nordic (CPSE:BAVA) — in that order. They all have a durable competitive advantage, generates strong FCF, and are trading at compelling valuations. In a market marked by elevated uncertainty, we see these businesses as fundamentally well-positioned to weather the current stormy environment.

Including Canada, the European Union, Japan, Norway, Switzerland, the United States, and Macao (China), which together account for ~90% of global production of pharmaceutical chemicals at the time of the agreement (estimated to be ~75% as of 2025)

Patients (out-of-pocket payors), Private Insurers & PBMs, Federal & State Programs

As per S&P Capital IQ’s assessment

In the above "Benchmarking" tyble the Astra Zeneca Description text was copied in twice and thereby overwrites the Novo Nordisk description?