Loomis (OM:LOOMIS) is a global leader in cash and valuables logistics/handling — an out-of-favor, high-barrier industry where scale, route density, and regulatory complexity deter competition. While the structural decline in cash usage is well understood, we believe the pace of that decline — and its impact on the cash handling industry — is overstated.

Cash transactions have contracted -4% p.a. L5Y, accelerated by the pandemic. Despite this, Loomis has delivered +4.2% organic revenue CAGR over the same period. This is a function of the company’s exposure to cash in circulation (growing LSD p.a.) and its velocity, rather than the proportion of cash-based transactions — although we are not denying they are directionally correlated over the long term. Still, the market continues to imply a collapse in cash volumes, overlooking the growing regulatory support for cash infrastructure and the risks posed by an all-digital payment ecosystem, as evidenced by recent IT-/power outages.

Loomis currently trades at 4.0x EV/EBITDA (2027E) and offers an annual unlevered FCF yield of ~13–15%. Our framing is simple: if Loomis manages to grow FCF by 2% p.a. through 2033, it effectively recovers its entire EV — leaving any residual value as upside. We view that as conservative. With embedded growth from Automated Solutions (SafePoint) and structural tailwinds in ATM outsourcing, SME logistics, and LATAM expansion, we believe current valuation fails to reflect the company’s earnings durability and re-investment runway.

01. Company overview

Loomis (OM:LOOMIS) is a leading global provider of cash and valuables logistics, offering services across the full value chain — incl. distribution, handling, storage, and recycling — to financial institutions, central banks, and retailers. Listed in 2008 following its 100% spin-off from Securitas (OM:SECU B), the company operates with a localized and dense logistics network on a global scale, holding a #1–2 position in most of its core geographies. The service model spans both physical infrastructure (e.g., cash-in-transit and ATM replenishment) and value-added services (e.g., cash management, FX, etc.).

Loomis operates in an out-of-favor but highly resilient niche. High capital intensity, route density requirements/scale, and regulatory complexity generally deters new entrants. Sales are diversified1 and largely contracted, typically structured with 3–5 year durations and include termination rights, but in practice, relationships tend to last far longer. We estimate the average customer tenure for legacy offerings to be ~10 years, supported by operational entrenchment and limited viable alternatives. Loomis’ integrated offering forms a closed-loop ecosystem, where complementary services reinforce each other and create meaningful cross-sell opportunities — deepening customer lock-in over time.

02. Industry overview

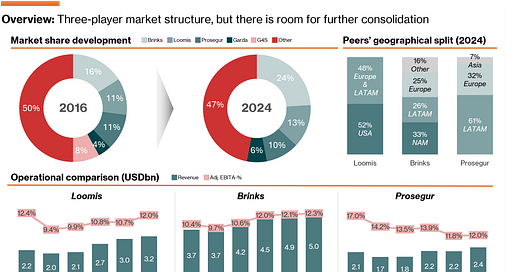

The total addressable cash management market is estimated to be USD ~23bn and dominated by a few global players, which together controls roughly half of the market. These include2 Brinks (NYSE:BCO), Loomis (OM:LOOMIS), Prosegur Cash (BME:CASH), and GardaWorld (private). The market’s consolidated structure has fostered pricing discipline, with annual increases tracking at or slightly above GDP growth. As such, competition is less about price and more about service quality/reliability.

Brinks acquired G4S’s cash operations in 2020, adding ~8pp to its market share and making it the clear market leader. Loomis has also been active in M&A, though on a smaller scale (bolt-ons), having added ~2pp market share L8Y. Prosegur has faced tougher competition from the likes of Brinks entering the LATAM market. These shifts are mirrored margin dynamics: Brink’s has benefited from growing its LATAM exposure — where underlying margins are structurally higher but also come with elevated risks. Meanwhile, Prosegur has faced margin pressure mainly due to cost inflation on its OPEX base. Yet, Loomis has remained focused on growing within its core markets in Europe and USA, particularly in within managed ATM services and digital retail solutions — with less exposure (~3% of sales) to LATAM.

The same LATAM exposure that drives higher margins has also inflated reported organic growth rates as sizeable price increases have been implemented to offset currency devaluation in high-inflation markets. Brink’s and Prosegur have delivered organic revenue CAGR of 5.5% and 16.8%, respectively, since 2016 — materially above Loomis at 3.8%. As elaborated later, Loomis has been explicit about its intent to expand within LATAM, hence we would expect to see a pick-up in organic growth and margins.

Cash is far from dead

Over the past decade, the use of cash as a medium of exchange has declined materially — a trend that was amplified by the pandemic. Despite this, the volume of cash in circulation has grown steadily at a 2-4% annually. This distinction is essential as Loomis’ business is more closely tied to the stock of cash outstanding and its velocity than to its share of total payment volumes. Granted, there is a directional correlation over the long term but the relationship is not linear. Several exogenous factors shape the volume of physical cash — incl. inflation in low-value items (where cash is more often used), shifts in consumer demographics, and central bank policies around note issuance (e.g., the ECB’s phase-out of the EUR 500 note in favor of higher volumes of smaller denominations).

Importantly, institutional support for cash remains strong. The ECB’s Eurosystem cash strategy explicitly commits to preserving euro cash as a widely available and accepted instrument — both as a payment mechanism and a store of value. To that end, the few countries that have tried to eliminate cash (e.g., Sweden) ultimately reversed course.

Support for a continued cash-able society tends to be rooted in: (i) Resilience: Cash provides an offline, failure-resistant backstop in a system increasingly vulnerable to cyber threats and digital outages, as exemplified by the 2024 global IT outage or the more recent power-grid breakdown in Spain and Portugal. (ii) Inclusion: For unbanked or underbanked populations, cash remains the default and often only viable medium of financial participation. (iii) Privacy: As surveillance of digital behavior grows, the option of anonymous payment becomes more socially salient.

Beyond the policy layer, behavioral responses are also shifting. SMEs in particular have increasingly encouraged cash transactions, citing the high and rising cost of card-based payment networks. This dynamic is particularly evident in the UK, where cash usage has recently rebounded. In that context — as elaborated below — Loomis’ renewed focus on SME solutions fits squarely within this trend.

We see three core trends that enable Loomis to capitalize on the tail-end of the cash industry — and potentially extends the terminal value horizon beyond what the market currently implies.

Opportunity #1: Outsourcing of ATMs

As banks close branches to streamline operations, they’re left with a fragmented ATM footprint — expensive and inefficient to operate at scale. To address this, many are outsourcing ATM operations to specialists like Loomis who have the regulatory familiarity across jurisdictions and proven operational track. While this trend has been ongoing for a while, there is meaningful runway ahead as ~60% of ATMs in core addressable markets (Europe, LATAM, USA) are still bank-operated.

There is no universal regulation requiring ATMs to remain in operation indefinitely. However, most countries have rules in place to ensure that cash remains available, accessible, affordable, and secure for the public. Regulatory standards can vary by country — covering areas such as minimum cash buffer levels, refill frequencies, and fraud prevention protocols. For instance, in France, in/at-shop ATMs are legally required to be empty outside of business hours.

Opportunity #2: Penetrating the SME market

A consequence of banks scaling back their physical presence is that many SMEs have been left without convenient access to cash services, creating a large- and growing cohort of underserved businesses. With Loomis’ dense logistics network, adding incremental SME volume to its routes should relatively “plug-and-play” and absorbed with minimal added costs. As shown below, most retailers withdraw/deposit cash OTC at banks or via ATMs, yet few use CIT providers — potentially due to such clients falling out of scope historically.

In addition to growing its legacy offerings within the SME segment, Loomis have also done efforts to capitalize on the shift away from cash via its introduction of Loomis Pay in 2020. While arguably a decade too late, Loomis Pay is a logical entry-point for bundled upselling. That said, it is premature to assign material upside to the offering until adoption reaches critical mass. However, worth noting that Loomis has a decent track record of growing “new” products, as evidenced by its Automated Solutions offerings.

Opportunity #3: LATAM expansion

LATAM has been a key driver of margin growth across industry peers. Yet, Loomis’ current exposure remains limited (~3% of sales), with operations primarily in Argentina and Chile via smaller acquisitions. Management has long been vocal about the attractiveness of the LATAM region, but has been held back from leaning into it due to disruptions brought by the pandemic and macro instability — particularly in Argentina. With signs of stabilization and easing inflation in select markets, Loomis has returned to a more proactive stance. This was explicitly reinforced at the recent CMD, where management highlighted LATAM as a near-term focus for both organic and M&A-driven growth.

LATAM is a great region to expand. They have great growing countries, and we're already present there with Argentina and Chile, but that's going to be our primary focus on expanding into high-growing markets.

- Aritz Uribiarte, President & CEO

Further, multiples have come down considerably following the deal mania during 2020-2023, going from 10-13x toward 5-8x EBITDA — which alongside the company’s strong balance sheet — is supportive for near term M&A activity.

03. Performance

Loomis has delivered resilient operational performance L5Y, underpinned by stable MSD organic revenue growth and disciplined cost management. Despite temporary disruptions during the pandemic, the business has reverted to its historical trajectory, demonstrating a high degree of predictability in both topline and profitability.

2019–2020: COVID-19 caused a temporary dislocation in volumes, particularly in CIT and retail cash handling, resulting in both a topline and margin dip. However, cost flexibility and re(oc)curring offerings offset some of the downside.

2021–2022: Strong post-pandemic bounce, supported by normalization in retail activity. Organic growth rebounded to above-trend levels, driven in part by pent-up demand and base effects. Margins still trailed its pre-pandemic levels.

2023–2024: Growth slowly tapering off, yet still above its pre-pandemic levels owing to strong execution in “adjacent” categories. Margins finally reached its pre-pandemic levels — yet remains slightly “dragged” by Loomis Pay (~0.7pp headwind). The company has also shown early signs of renewed M&A momentum, with management signaling increased interest in LATAM expansion.

Beyond headline metrics, the company has executed well operationally. During the pandemic, management refocused capital allocation toward organic initiatives while actively returning capital to shareholders (cumulative SEK 5.9bn ‘19-’24). We believe the foundation for continued shareholder returns in the SEK 1.4-1.8bn range by 2027 is well-supported, underpinned by a step-up in incremental ROIC (from SME volumes and LATAM expansion) and strong FCF generation (~12% FCF margin)

Implied expectations discount future growth- and earnings potential

At its recent CMD, management introduced new financial targets, guiding for a 5-7% revenue CAGR through 2027 and EBITA margins in the 12–14% range. We view these targets as relatively cautious in light of the three growth opportunities outlined earlier (ATM outsourcing, SME penetration, LATAM expansion) which should support both topline acceleration and earnings momentum.

The conservative stance on topline CAGR is perhaps justified by a normalization of base effects following a volatile 2022–2024 period, alongside FX headwinds (strengthening SEK vs. major currencies). Yet, consensus estimates imply just 2% revenue CAGR through 2027 — a level that would suggest meaningful loss of volumes net of pricing efforts. We do not think the momentum in SafePoint-/automated solutions and managed ATM services are adequately captured in estimates — not to mention the upside optionality from SME- and LATAM penetration.

On margins, consensus sits at the midpoint (13% EBITA margin) of management’s range. While this appears more grounded, we note that management has conveyed confidence in reaching the top-end of the range. Provided the company manages to continue current momentum on higher-margin solutions (i.e. Automated Solutions), then we see a credible path toward exceeding the upper-end of the target.

04. Valuation

There is no denying that cash will continue to decline — and that, over time, this trend will be reflected in the volume of cash in circulation; a key driver of Loomis’ core business. However, Our variant perception is that the market is overly aggressive in its assumptions around the pace at which cash becomes obsolete. This dynamic is industry-wide, making peer-based valuation less informative.

Even so, Loomis currently trades at 4.0x EV/EBIT (2027E) versus 6.0x for Brink’s and 4.4x for Prosegur Cash. We see no compelling rationale for Loomis to trade at a discount to Brink’s (let alone Prosegur Cash), especially as its margins expand toward management’s 2027 target. For what its worth, Brink’s acquired G4S’s cash operations at an EV/EBITDA multiple of ~7.5x (~6.5x post synergies).

We also do not consider the standard DCF as the right approach given its sensitivity to terminal value assumptions, which are material in this particular case. After all, a core element to the thesis is a bet on “how far out” the tipping point is. As such, we propose a much simpler framing: If Loomis manages to grow FCF at a CAGR of 2% for the next 7 years, the entire EV is effectively recovered — theoretically making any incremental SEK earned beyond that point pure upside. We view that scenario is conservative and achievable in the context of the structural regulatory support, alongside the ongoing mix shift toward higher-margin offerings and the breakeven trajectory of Loomis Pay. We believe fair value in the SEK 550/share area, bringing valuation closer to that of niche logistics peers.

No single customer represents more than 10% of sales. Prosegur Cash’s IPO prospectus (2017) points to top-8 customers accounting for ~30% of sales (p. 117); we’d expect this to be directionally similar for Loomis.

Excluding players in non-core regions (e.g. Asia), incl. CMS Infosystems (IN:CMSINFO) and Alsok (TSE:2331)

Thanks for this one, very interesting. Loomis does seem undervalued and the price looks nice. But I still do wonder about the future of cash, despite your great insights. Maybe more, I wonder about Loomis's return on capital. Lower than I'd like. Is that a worry to you too? In any case, thanks again. Well done.