The property and casualty (P&C) insurance industry underpins nearly every economic activity globally. At its core, many pay for the losses of the few. Policyholders transfer future risk by paying upfront, and insurers absorb that risk, aiming for claims to come in below premiums over time. Profitability depends on pricing risk accurately, managing claims efficiently, and allocating capital with discipline.

Few markets are built to support all three. The Nordic P&C market is a rare exception. In this piece, we examine the mechanics behind said structural advantage, why the region has lagged broader sector performance in recent years — and why we believe it is positioned to re-rate as market conditions shift.

A system designed for durability and discipline

Over the past decade, Nordic P&C insurers have delivered an average combined ratio of ~85%; a full +10pp points ahead of the broader Europe & UK average. Just as notable as the margin itself is the consistency, with a standard deviation of only ~1pp over the same period.

The outsized returns are enabled by the structural characteristics of the Nordic market. The high market concentration drives scale-/scope efficiencies, rational pricing, and OPEX leverage. Price discovery is limited and the customer acquisition typically starts directly with the insurer — although sometimes referred from employers, real estate agents, etc. This is unlike other European markets where price comparison websites play an important role in the top of funnel. This dynamic means that, Nordic insurers enjoy far superior retention rates (85–90%) and CLTVs (8–10 years) compared to any of its neighboring regions.

On the asset side, Nordic insurers carry materially lower credit risk than their European peers. For instance, Tryg (CPSE:TRYG) has near-zero exposure to sub-investment grade credit, while Sampo (HLSE:SAMPO) holds ~32% — both well below the European sector average of ~60%. This translates into lower earnings- and share price volatility, which is something we believe will be rewarded in the context of the current macro sentiment.

Premium compression — warranted, but overdone

The defensive characteristics and stable return profile of Nordic insurers have long supported a substantial valuation premium, trading at an average ~65% P/E premium to the broader European insurance sector (SXIP) L5Y. However, recent years’ relative underperformance has narrowed that premium to its lowest level in the past decade.

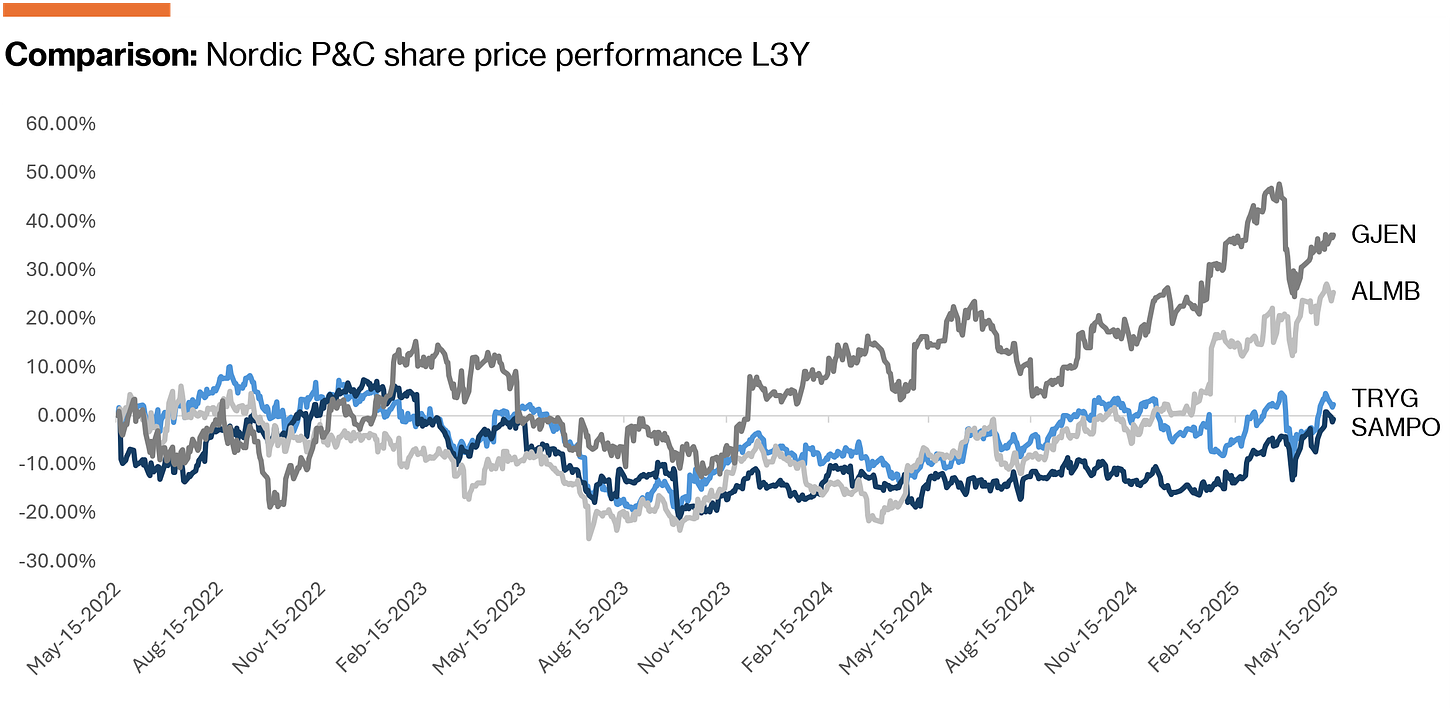

The trend is also evident in the share price development, with the SXIP index trumping Nordic P&C returns by 3x over the past five years:

While the performance carries weight from company-specific events, we argue bulk of the downward pressure can be explained by three core developments.

Step-up in interest rates: Nordic P&C insurers remain focused on generating strong technical results — primarily through disciplined underwriting and net written premium growth — while investment returns play a less prominent role. In contrast, many European peers rely more heavily on investment income to support profitability. In higher-rate environments, where investment returns become a more dominant earnings driver, the relative performance gap narrows as European peers benefit disproportionately. When yield tailwinds fade, the advantage shifts back toward models built on underwriting discipline — where Nordic insurers consistently outperform.

Hardening market cycles: Nordic pricing trends tend to be less cyclical, with narrower peaks and troughs relative to global peers. Recent years’ elevated tail events, inflation-linked reserve pressure, and constrained retrocession capacity have driven sharp repricing and premium growth across non-Nordic markets. For context, the Lloyd insurers saw cumulative price increases of >80% vs. 2019 levels, and the U.S. sustained its longest pricing upcycle from 2019 through early 2024.

Record large-losses in the Nordics: A series of outsized weather and industrial losses in the Nordics have weighed on underwriting results in recent years, with several quarters of claims materially exceeding budget and thus weighing on combined ratios. One could argue such events will become commonplace in the wake of current climate change, yet we argue their effects will be smoothed by pricing efforts in the longer term.

Conditions are in place for a re-rating

After ~8 years of a hardening cycle, early signs point to softening momentum outside the Nordics. As earnings tailwinds fade and macro uncertainty rises, investor preference tends to shift back toward stability, visibility, and capital discipline; areas where Nordic names remain best-in-class.

While still in its early stages, some European P&C providers — particularly those with lots of UK and Germany exposure — have confirmed the softening of the market, whereas others (e.g. AXA) continue to see a hardening market in France and Belgium.

In our view, current valuations provide an attractive entry point into some of the highest-quality names in the sector. With average total capital return yields of ~6.5%, conservative balance sheets, and defensive business models, the setup offers compelling downside protection.

Regulatory overhang in Denmark

On April 1, 2025, the Danish Consumer and Competition Authority (DCCA) published a report on competition in the non-life insurance market. While broad in scope, the report's primary focus is whether to initiate a formal investigation into how insurance premiums and contract terms are set. Two core points raised in the report are worth highlighting:

Price indexation: Insurance premiums are often contractually indexed to private sector wage growth (~3.5% for 2025), with no customer notification unless increases exceed the benchmark. The DCCA argues this practice has led to premium increases outpacing inflation, claims costs, and EU peers. Our view (consensus) is that the review may disallow salary-linked price indexation going forward, aligning Danish insurance pricing more closely with international standards (i.e. pricing based on company-level discretion).

Loyalty Penalty: Data suggests that loyal customers are worse off. Hence, the DCCA may also address differential pricing between new and existing customers. While the gap is less pronounced than in the UK, the DCCA could introduce limits on renewal pricing. We believe the impact would be modest, given the relatively low level of customer churn in Denmark.

Among listed insurers, Tryg (CPSE:TRYG) and Alm. Brand (CPSE:ALMB) are most exposed to Denmark and thus most affected by regulatory uncertainty. Gjensidige (OB:GJEN) is primarily Norwegian-focused, while Sampo (HLSE:SAMPO) has a more diversified footprint. A final decision as to the next steps is expected to be announced by DCCA in the coming months.

Our picks

While the region shares structural advantages, company-specific positioning varies meaningfully — and not all names are equally placed for a re-rating scenario. As such, this section aims to contextualize the relative attractiveness across the listed Nordic P&C universe.

Since late 2023, GJEN has re-rated meaningfully relative to Nordic peers, supported by fast and effective pricing actions to offset claims inflation. ALMB has also seen sentiment recover, mainly driven by visible progress on its Codan integration and divesting its Energy & Marine business. In contrast, SAMPO and TRYG have both trailed — despite the latter historically trading at a meaningful premium to the Nordic P&C group.

Geographic and customer exposure differs meaningfully across the Nordic P&C players — and these differences matter more today than usual. Both TRYG and ALMB are most exposed to the outcome of the DCCA review, with the latter particularly vulnerable given its full reliance on the Danish market. In contrast, SAMPO stands out as the most geographically diversified, with exposure spanning the Nordics and the UK. However, that same diversification comes with the trade-off from its relatively higher sensitivity toward capital market volatility (~32% of contribution from investment income).

We acknowledge that size and diversification differ across these names (see below), which can dilute direct comparisons. However, the region’s concentrated structure, similar product offerings, and overlapping end-markets make it both relevant and instructive to assess relative performance and valuation shifts across the group over time.

Tryg (CPSE:TRYG): With M&A appetite behind it, Tryg is focused on shareholder returns, offering a 6.3% all-in FY26e yield. Shares trade at 16.9x 2025e P/E, near a 10-year low, despite materially higher capital efficiency today; Return on Own Funds at ~40% in 2024A vs. ~20% pre-2018. In our view, the disconnect is unwarranted, given stronger underwriting quality, minimal reliance on investment income (~8% in 2024A), and a simple, high-quality balance sheet (>95% in AAA-rated government and covered bonds). Tryg’s earnings mix skews private and is well diversified across the Nordics, with low asset leverage and limited macro sensitivity. While regulatory risk in Denmark and claims inflation in Norway are overhangs, the latter appears to progress well with YoY price increases now exceeding inflation — supportive for margins near-term. Yet, the outcome from a potential DCCA may dilute sentiment despite our sensitivities suggesting a ban on loyalty premiums would be manageable despite being a material short-term headwind.

Alm. Brand (CPSE:ALMB): Now a focused non-life insurer, Alm. Brand has navigated a difficult environment well, delivering on integration and pricing targets. While synergies from the Codan acquisition are tracking ahead of plan, we continue to view the deal as expensive given the asset’s lower quality at entry (CR ~100%), raising questions around capital allocation discipline. The stock offers an attractive ~7% all-in yield, helped by a DKK 1.6bn special distribution (buybacks; DKK 655m remaining) from its Energy & Marine divestment. Trading at ~16.7x 2025e P/E and 2.0x P/B, upside from incremental margin step-ups and further cost efficiencies exists, though we flag its smaller scale and full exposure to Denmark as potential amplifiers of regulatory risk compared to peers like Tryg.

Gjensidige (OB:GJEN): Having re-rated sharply on the back of early and aggressive pricing actions in Norway — while maintaining customer retention — the company now trades near historical highs across most valuation multiples. We believe much of the upside is priced in. Outside Norway, Denmark (~25% of 2024A sales) remains a profitability drag, constrained by subscale operations. While M&A could be a path (e.g. ALMB) to improvement, limited deal flow and heightened regulatory scrutiny reduce near-term visibility. With an all-in yield of 4.3%, we see more attractive risk-reward among other Nordic P&C names.

Sampo (HLSE:SAMPO): Now a focused P&C insurer, Sampo has reshaped its portfolio through the Nordea exit, Mandatum spin-off, and full acquisition of Topdanmark. The group’s diversified footprint across the Nordics and UK supports a resilient earnings base and limits exposure to Denmark-specific regulatory risk (~13% of revenues from Danish personal lines). While the stock trades in line with peer levels, we see further upside as capital optimization levers are activated — including partial monetization of its ~EUR 600m private equity portfolio, realization of Topdanmark synergies, and ~10% earnings growth through 2028. Sampo targets EUR >4.5bn in deployable capital over 2024–26, with EUR ~2bn already delivered. We expect this to be exceeded, with incremental capital returned to shareholders via buybacks and distributions.

As such, we remain constructive on Nordic P&C broadly — aided by softening market cycles outside the region and rising macro uncertainty. In that context, we view TRYG and SAMPO as best positioned for a meaningful re-rate over the next 12–18 months.

Thanks for a great writeup... how do we know that the 2016-2019 relative multiples were not the "right" multiple and therefore we are back to FV? Don't we need to compare ROE and growth rate then and now or vs the index to get a sense of what multiple they "should" trade at (thinking Dupont equation or something like that"? thanks again

You likely receive hundreds of pitches.

This isn’t one of them.

Hello @Nordic Edge,

Share deep respect for what you have built here.

I am the Founder and Steward of the 100x Farm.

The 100x Farm is a quiet strategy sanctuary for investors and capital stewards with long memories and longer horizons.

No noise. No dopamine. No trend-chasing.

Just deep-cycle clarity earned slowly, shared rarely.

We don’t believe in inbox conquest.

But if the idea of sowing $10,000 seeds to harvest $1 million trees over 20- 30 years feels familiar,

you and your patrons may already belong here.

What if the next 100x isn’t a stock but a forgotten business model hiding in plain sight?

Every thesis is backed by real capital, filtered through over 100 long-cycle lenses before it earns a word.

And if nothing else, this may help you filter what isn’t worth your time.

No urgency. No ask.

Only signal.

Warmly,

The 100x Farmer