Markets in Europe moved cautiously upward as investors weighed the ongoing tariff circus and the anticipated 25bps rate cut from the ECB. The trade war narrative continued to evolve on the back of Trump doubling tariffs on steel and aluminum imports to 50%, spurring surprisingly little panic. At this point, the market seem increasingly comfortable discounting headline noise from the U.S. administration. The ECB rate cut marks the eighth cut in a row in the eurozone’s easing cycle, albeit this time delivered with a cautionary tone by Lagarde, highlighting asymmetric downside risks from geopolitical trade frictions.

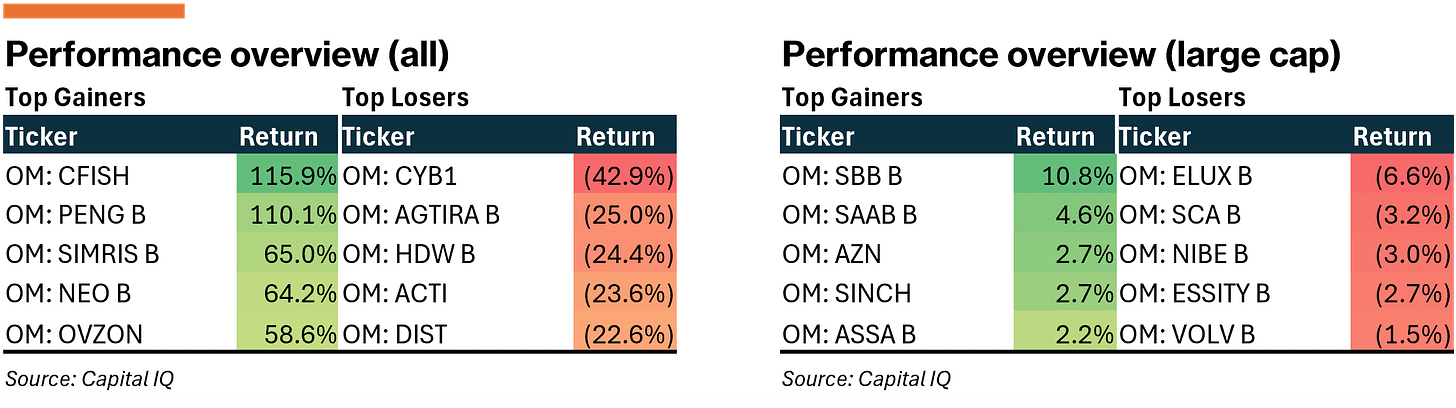

Nordic markets largely mirrored the wider market sentiment, with the all-share index ending the week up 2.4%.

Denmark

In Copenhagen, news flow was relatively muted aside from a few corporate events. The all-share (4.4%) and large-cap (2.8%) indices ended the week1 on a positive note, narrowing the performance-gap vis-á-vis its Nordic peers.

Gubra (CPSE:GUBRA) shares rose sharply over the past week, driven primarily by the announcement of an extraordinary dividend of DKK 61.20/share (13% yield on last close), funded by proceeds from the March licensing of Gubamy to AbbVie. The AbbVie deal itself is worth USD 2.2bn (DKK ~14.5bn) of which USD 350m (DKK 2.2bn) is to come from upfront payments and the remainder from milestone payments and royalties.

Other relevant news:

Genmab (CPSE:GMAB) reported promising mid-stage data on “Rina-S” in endometrial cancer, with a 50% response rate across 64 heavily pretreated patients.

Fynske Bank (CPSE:FYNBK) and Nordfyns Bank (CPSE:NRDF) merger faces pushback from Nordic Compound Invest (sub-5% holder), arguing that the board has not sufficiently explored alternative options to maximize shareholder value. Latest, the majority owner (24.6%) of Nordfyns Bank (CPSE:NRDF), SJF Bank (CPSE: SPKSJF) announced they will not support the merger, citing the exchange ratio/implied price as not sufficiently attractive.

Maersk’s (CPSE:MAERSK B) June 2025 North America Market Update reveals that despite geopolitical uncertainties and tariff fluctuations, demand across key trade lanes remains robust and capacity tightening — incl. APAC-North America routes following the recent tariff-pause.

FLSmidth (CPSE:FLS) acquires SSRE, a rubber engineering firm with operations across Africa, enhancing its Mining aftermarket service footprint in Africa.

Novo Nordisk (CPSE:NOVO B) escalates its lobbying in Washington, warning that unauthorized Chinese-made copies of its weight-loss drug pose a national security risk, and that tariffs on legitimate pharmaceutical imports would disrupt patient access and threaten investments. We have investigated the effects of tariffs in the context of Nordic pharmaceuticals, see below.

Sweden

It was a relatively eventful week in Stockholm, featuring CMDs, biotech licensing deals, and looming investor pushback on EQT’s buyout of Fortnox (OM:FNOX). The all-share (0.8%) and large-cap (0.5%) indices ended the week2 on stable footing.

Autoliv (OM:ALIV SDB) hosted its CMD where management reiterated its FY2025 guidance and long-term adj. EBIT margin target of 12% (vs. 9.7% in FY2024A). The margin expansion is expected to come from ~80bps in cost savings, ~60bps from call-off normalization, and ~90bps from volume growth and automation. Capital returns will rise meaningfully, with a 20% dividend hike and USD 300–500m in annual buybacks through 2029, offering a combined shareholder yield of ~8% at current prices.

Management expects full OEM pass-through for the estimated USD 100m in incremental tariff costs tied to metals and non-USMCA components. Further, management underscored that Autoliv is favorably positioned to piggyback incremental volume gains by Chinese OEMs. At current, its market share among Chinese OEMs is ~23% and is expected to grow to ~30% by 2026, driven by new launches and customer wins. Further, management argues the company stands to benefit from Chinese OEMs expanding abroad (e.g., OEMs opening sites in Europe).

Other relevant news:

EQT (OM:EQT) and First Kraft’s SEK 54.9bn bid for Fortnox (OM:FNOX) faces resistance from AMF and Lannebo (7.2% combined ownership). EQT stands firm on its current offer, which is set to expire June 10 and requires 90% acceptance. Shares currently trade at a ~4% discount to the bid price — and a ~32% premium to the pre-bid (day prior) share price.

Sweco (OM:SWEC B) launched a SEK 15/share (equiv. SEK 527m EV) public offer for Projektengagemang (OM:PENG B) — a 117% premium to the day-prior close. The bid implies a 7.3x EV/EBITDA and has received the backing of shareholders holding approximately 62.62% of the outstanding shares and 80.79% of the voting rights.

Camurus (OM:CAMX) surged after striking a USD 870m (SEK ~8.4bn) licensing deal with Eli Lilly. The agreement gives Eli Lilly exclusive rights to research, develop, manufacture and commercialize long-acting incretin products based on Camurus’ Fluid Crystal technology. Further, the agreement entitles Camurus to a mid-single-digit royalty on product sales.

The UK plans to cut green levies on electricity used by heat pumps to spur adoption — potentially unlocking volume upside for NIBE (OM:NIBE B), whose systems are well-positioned to benefit as the UK pivots from gas boilers (still heating most homes) toward its ambitious 600k annual target by 2028.

Avanza (OM:AZA) and Nordnet (OM:SAVE) reported sharp drops in May net inflows — down 85% and 54% MoM, respectively — indicating slowed retail trading activity.

BioArctic’s (OM:BIOA) CMD reiterated the near-term inflection from Leqembi royalties, which are expected to cover core costs from 2026 and enable sustainable profitability. Management flagged ongoing BD efforts tied to its brain transport platform, with further partnerships likely. While Leqembi remains the near-term driver, pipeline optionality — notably exidavnemab — and strategic interest from large pharma should underpin longer-term upside.

Finland

In Helsinki, the CMD events continued as Valmet (HLSE:VALMT) and Mandatum (HLSE:MANTA) unveiling new long-term financial targets. The all-share (0.8%) and large-cap (0.9%) indices ended the week in positive territory.

At Valmet’s (HLSE:VALMT) CMD, management released its 15% comparable EBITA margin target (prev. 12-14%) for 2030, supported by EUR 180m in identified cost savings. The savings will come from a newly formed Global Supply function aimed at centralizing procurement, logistics, and manufacturing across 37 production units (EUR 100m) and existing efficiency programs already in motion (EUR 80m). The savings imply ~330bps of margin uplift from the 11.3% baseline, offering potential mid-single-digit upside to 2025–26 EBITA estimates.

The company will reorganize into two business units — Biomaterial Solutions & Services and Process Performance Solutions and thus Services will no longer be broken out as a standalone segment. Margin targets were set at 14% for Biomaterials (vs. LTM 10.5%) and 20% for Process Solutions (LTM 17.6%). The group targets 5% organic sales CAGR and 20% ROCE by 2030. In Biomaterials, the goal is to double organic service growth to 8% CAGR and raise service market share from 21% to 25%. In Process Solutions, the company targets organic growth of more than twice the market rate, supported by rising lifecycle service content and digital expansion.

Other relevant news:

Sotkamo Silver (HLSE:SOSI1) announced promising exploration drilling results that suggest a possible extension of its mine’s life to 2035 — the timing coincides with a strong rally in silver prices, which reached their highest level in over a decade.

Verkkokauppa.com (HLSE:VERK) will divest its consumer financing unit to Norion Bank and Walley for EUR ~34m. The deal includes a long-term partnership on financing solutions and frees up capital to sharpen its focus on core online retail. The exit also simplifies operations ahead of a potential re-rating story.

Mandatum (HLSE:MANTA) has set new financial targets for 2025–2028, aiming for an ROE of >20%, >10% annual pre-tax profit growth in its capital-light business, a solvency ratio between 160–180% (prev. 170-200%), and cumulative shareholder distributions exceeding EUR 1bn.

Finnair's (HLSE:FIA1S) May passenger count rose 3.4% YoY to 1.02 million, with capacity (ASK) up 6.6% and revenue passenger kilometers (RPK) up 8.3%, driven by strong transatlantic and Asian traffic. However, upcoming strikes on June 17 and 19 are expected to cause significant disruptions.

Bittium (HLSE:BITTI) landed a EUR ~3m defense order from a European military client (unnamed). The deal involves delivering a tactical communication solutions.

Tallink’s (HLSE:TALLINK) May passenger volume dipped 2.0% YoY to 472.7 thousands, with cargo units down 19.8% and passenger vehicles off 4.7%. The Estonia–Finland route saw a 4.7% decline in passengers, while Estonia–Sweden traffic rose 7.0%. Separately, the company chartered its cruise ferry, Romantika, to Algeria’s Madar Maritime for nine months starting May 31, with optional extensions.

Norway

Shares keep marching forward in Oslo, breaking new all-time-highs despite end-market jitters for heavyweight cyclical companies. The week also featured IPO momentum as Ratos-owned Sentia published its prospectus. The all-share (1.7%) and large-cap (1.3%) indices ended the week up.

While there were limited major events last week, it is worth highlighting that Zalaris (OB:ZAL) expects to conclude its strategic review by end-June, exploring options ranging from asset sales to a full exit or platform-led scaling. Given its position in HR/payroll outsourcing, the company looks ripe for PE interest, with clear scope for margin expansion alongside continued growth. The company trades at a fwd EV/adj. EBIT of ~10.7x, a +30% discount to peers.

Other relevant news:

Norwegian government exited its ~6.3% stake in Norwegian Air Shuttle (OB:NAS) just weeks after becoming a shareholder through bond redemptions. The block sale raised NOK 892m, yielding a pre-cost gain of NOK ~276m.

Norse Atlantic Airways (OB:NORSE) reported a 41% YoY jump in passengers to 182,854 in May. Load factor surged to 96%, +15pp YoY — an all-time high. The long-haul low-cost carrier has leaned more heavily into charter flights in recent months to stabilize yield.

Pandox (OB:PNDX B) and Eiendomsspar launched a EUR 1.3bn bid for Ireland-listed Dalata Hotel Group at EUR 6.05/share (equiv. ~27% day-prior premium). Dalata’s board unanimously rejected the offer, despite Ringnes-controlled Eiendomsspar owning a substantial minority.

Biofish (OB:BFISH) board supports a voluntary cash offer from Langøylaks at NOK 1.77/share and NOK 0.47/warrant, implying a NOK ~230m equity value. The offer comes at a ~45% day-prior premium and is fully funded and pre-accepted by holders of 52.4%.

Kongsberg Automotive (OB:KOA) announced a large C-suite and divisional restructuring, eliminating roles including CTO, Sales, and Engineering leads. Changes follow cost-cutting and a board reshuffle catalyzed by Arne Fredly’s activist push post his stake build in Q4-2024.

Ratos-owned Sentia has filed for an IPO on the Oslo Stock Exchange, aiming to raise up to NOK 1.6bn, with the listing anticipated around June 13 under the ticker “SNTIA”. The company reported FY2024 revenue of NOK 10.6bn and an EBIT margin of 5.4%.

Kongsberg Gruppen (OB:KOG) secured a major contract to supply Joint Strike Missiles (JSM) for Germany’s F-35 fleet — adding the country to a list that includes Japan, the U.S., and Australia. The agreement, valued at NOK ~6.5 billion, comes at anticipated EBIT margins of 30–40%, well above Kongsberg’s group average.

Returns are based on the closing price Friday June 06 relative to the closing price Wednesday May 28 due to due to national holidays.

Returns are based on the closing price Thursday June 05 relative to the closing price Wednesday May 28 due to national holidays.