NOTE: This update serves as a follow-up to the initial write-up posted a few weeks ago. To the extent you are not yet familiar with the business or our investment thesis, we recommend reviewing that piece before diving into this update.

Sometimes less bad is good enough

Heading into the report, key topics for the market were repercussions from Brazilian market regulations and U.S. market dynamics amid less fierce competition among sportsbooks. As noted in our initial write-up, we view H1-2025 as a “flush-out” period, yet argued that consensus were overly pessimistic on the implied magnitude of Brazil-related headwinds. Thus far, that view appears to be holding water — though it remains early in the process.

“The shift towards a regulated market in Brazil from January 1, has so far gone better than expected, where especially player migration has performed well”

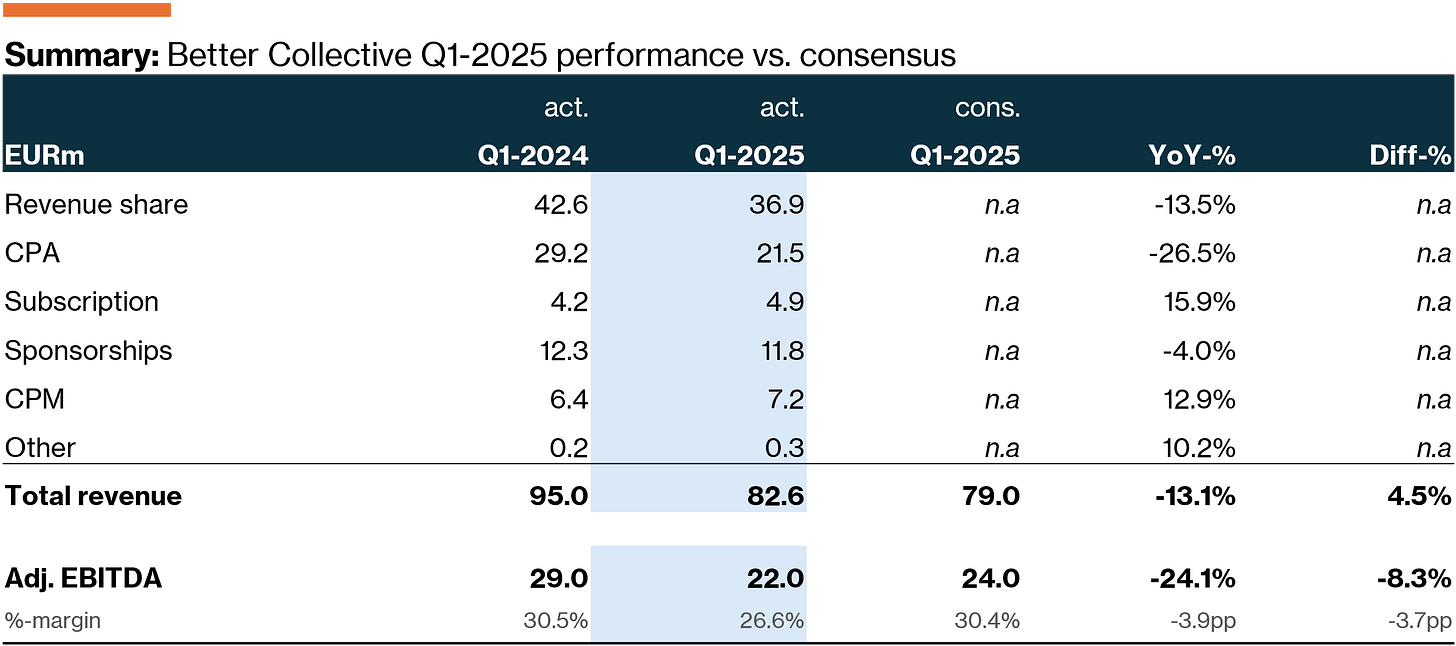

During Q1 2025, reported revenue declined -13% YoY (-18% organic) to EUR 83m (vs. EUR 79m cons.). The drop was attributable to: (i) regulatory impacts in Brazil (EUR -7m), (ii) no new U.S. state launches vs. LY (EUR -5m), (iii) reduced marketing spend from U.S. sportsbooks (EUR -5m), and (iv) player-friendly outcomes in the U.S. (EUR -2m). These headwinds were partially offset by growth in other markets (EUR +2m), as well as contributions from M&A and FX (EUR +5m).

That said, profitability came in below expectations, with adj. EBITDA at EUR 22m (EUR 28m cons.), constituting a 3.7pp shortfall, driven by (i) lower top-line contribution (EUR -12m), and (ii) M&A-related costs and FX headwinds (EUR -4m) — partially offset by cost reduction initiatives (EUR +9m).

As for new depositing customers (NDC), the company delivered 316k NDCs to sportsbooks (~80% on RevShare contracts), down -30% YoY. The decline was driven by the ban on welcome bonuses in Brazil (an item we will follow), with optics further distorted by difficult comps LY as volumes were temporarily elevated following U.S. state launches.

In connection with the earnings release, the company launched a EUR 10m share buyback program; the second of its kind this year after having completed the initial EUR 10m tranche in April 2025. Given the current valuation and balance sheet capacity, we would not be surprised to see further buybacks beyond the existing mandate as the year progresses.

Thesis remains intact

With most of the initial disruption from Brazilian regulatory changes now behind us, we look for continued sequential improvement in the region — a trend that should gain momentum as the domestic football season progresses. Similarly, we will monitor the level of competition (as a proxy for marketing spend) in the U.S. to gauge performance going into the coming quarters. As of current, the entry of new operators into the U.S. market has been relatively muted, with Draftkings and Flutter (FanDuel) holding most of the market; not ideal for Better Collective’s value proposition — but something we expect to change ahead of the 2026 FIFA World Cup, which will be hosted in North America. We will continue to track our ALT-data signals across regions (incl. web traffic, app downloads, player outcomes, etc.) — all of which point to a rebound in user engagement.

Even in the absence of any “catch-up” effect in the coming quarters (which we argue is overly conservative), the company is on track to deliver FY2025 revenue near the midpoint of its guided range. In fact, if the momentum in our ALT-data holds (and gets reflected in Q2-2025 figures), we would expect management to narrow the guidance-spread upward during H2-2025.

With shares trading at ~9x fwd EV/EBITDA (cons.), we continue to view Better Collective as materially undervalued. Current levels offer a unique opportunity to own a niche leader with a defensible position in a high-growth industry, generating strong cash flows and offering meaningful margin-/ROIC upside as RevShare scales and OSB traction accelerates in the U.S. and LATAM.

Super gennemgang! Og fedt med opfølgning på regnskabet ovenpå dit første pitch. Jeg er selv tæt på at tage en position i Better Collective, så det er virkelig værdsat input.

Når det er sagt, sidder jeg stadig med et par ting, jeg ikke helt kan slippe:

OCF ser stærkt ud umiddelbart, men det virker som om det primært er drevet af udskudte betalinger og lavt CapEx. Jeg ser det ikke nødvendigvis som et tegn på underliggende momentum?

NDC-faldet på -30% YoY bekymrer mig også lidt. Jeg forstår godt forklaringen med svære comps og brasilianske bonusforbud, men det ændrer ikke på, at man har brug for konstant tilgang af nye spillere for at få RevShare-modellen til at opnå en compounding effekt over tid.

Jeg er stadig positiv på den lange bane, men synes der er nogle elementer i Q1, der godt kunne udfordres lidt mere i analysen. Jeg forventer at tage en begyndende position snart, og vil glæde mig til at følge udviklingen videre mod Q2 og håber på tegn på en re-acceleration.

/Silas