The Federal Reserve held rates steady but flagged increased risks around both unemployment and inflation. That message was mirrored by the Riksbank and Norges Bank, which also stood pat. Late in the week, the U.S. administration announced its new trade pact with the U.K.; one of many trade agreements expected ahead of July 09 when the 90-day pause on “reciprocal” tariffs will end.

Similarly, this past week brought a heavy slate of Q1-2025 reports, with mixed results — the positives largely offset the negatives. The Nordic all-share index ended the week down slightly (-0.5%).

Denmark

In Denmark, a major wave of C25 earnings hit the tape, including updates from Novo Nordisk (CPSE:NOVO), Pandora (CPSE:PANDORA), Maersk (CPSE:MAERSK B), and Bavarian Nordic (CPSE:BAVA). The all-share index (-1.8%) and large-cap index (-1.4%) both ended the week in red.

We were particularly pleased to see Bavarian Nordic (CPSE:BAVA) execute well — one of the three names we flagged as high-conviction pick less than a month ago. The company delivered a standout Q1-2025 with revenue of DKK 1,347m (+62% y/y, +46% vs. cons.) and EBITDA of DKK 420m (+161% vs. cons.). The upside was driven by travel vaccines, which posted 52% YoY growth and came in 55% above consensus. Rabies and TBE vaccines exceeded expectations by 52% and 49%, respectively. Jynneos contributed DKK 629m — back-end loaded, as guided — still beating by 39%.

Full-year guidance was reiterated (DKK 5.7–6.7bn in revenue, 26–30% EBITDA margin), but the strong Q1 performance sets the stage for potential upward revisions. Separately, Bavarian secured a USD 144m order from BARDA (U.S. HHS) for Jynneos — to be delivered in 2026 — raising total contracted public preparedness revenue for 2025 to DKK 2,650m, already covering ~70–85% of guidance for that segment.

Next week, we key in on earnings from NTG (CPSE:NTG), Grønlandsbanken / Bank of Greenland (CPSE:GRLA), Lundbeck (CPSE:HLUN), and FLSmidth (CPSE:FLS).

Earnings review & other relevant news

Novo Nordisk (CPSE:NOVO B) reported Q1-2025 revenue of DKK 78.1bn (vs. DKK 78.7bn cons.) and EBIT of DKK 38.8bn (vs. DKK 37.3bn cons.), with net income of DKK 29.0bn (vs. DKK 27.9bn cons.). Wegovy sales rose 83% YoY to DKK 17.4bn but missed expectations (DKK 19bn cons.). FY2025 guidance was cut to 13–21% sales growth and 16–24% EBIT growth (prev. 16–25% and 19–27%), citing U.S. competition from compounded GLP-1s.

Novonesis (CPSE:NSIS B) delivered a strong Q1-2025, with revenue of EUR 1,077m (vs. EUR 1,069m cons.), up 26% YoY and 11% organically. EBITDA beat at EUR 412.8m (vs. EUR 399.3m cons.), with margin expansion to ~38%. Net profit jumped to EUR 186m (vs. EUR 33m LY). Growth was broad-based across all regions and segments. Guidance reiterated: 5–8% organic sales growth and 37–38% adj. EBITDA margin for FY2025.

Coloplast (CPSE:COLO B) reported Q2-2024/25 revenue of DKK 6,930m (vs. DKK 7,025m cons.) on 6% organic growth (vs. 7.8% cons.), with EBIT before special items at DKK 1,891m (vs. DKK 1,940m cons.). Growth in Chronic Care remained solid — +4% in ostomy and +8% in continence — while Urology declined 1% due to expanded product recalls (DKK 35m impact vs. DKK 15m expected). Ahead of the earnings release, CEO Kristian Villumsen stepped down with immediate effect; former CEO and current Chair Lars Rasmussen returns as interim.

Vestas (CPSE:VWS) posted Q1-2025 revenue of EUR 3.5bn, up 29% YoY and ahead of consensus (EUR 3.47bn). EBIT before special items came in at EUR 14m (vs. EUR -29m cons.), and pre-tax profit reached EUR 7m (vs. EUR -52m cons.), marking a solid beat across the board. Full-year guidance was reiterated (revenue EUR 18–20bn, EBIT margin 4–7%), though management flagged execution risk in the order backlog and ongoing U.S. tariff headwinds. CEO Henrik Andersen expects some cost pressure to be offset by higher electricity prices, ultimately passed to consumers.

ALK-Abelló (CPSE:ALK B) reported Q1-2025 revenue of DKK 1,522m (vs. DKK 1,494m cons.), up +12% YoY in local currency, driven by tablet sales of DKK 857m (vs. DKK 830m cons.). EBIT came in at DKK 469m (vs. DKK 392m cons., DKK 316m LY), implying a 31% margin. Net profit was DKK 354m (vs. DKK 296m cons.). FY2025 guidance was reiterated: 9–13% LC revenue growth and ~25% EBIT margin.

ISS (CPSE:ISS) posted Q1-2025 revenue of DKK 20.9bn (vs. DKK 20.8bn cons., DKK 20.1bn LY), with organic growth of 4.3% (vs. 3.2% cons., 6.0% LY), outperforming expectations despite a YoY deceleration. Cleaning and food services remained solid, with no change to the group’s cautiously constructive tone. Management reiterated its FY2025 outlook: organic growth of 4–6% and an EBIT margin of 5%.

Ambu (CPSE:AMBU B) reported Q2-2024/25 revenue of DKK 1,554m (vs. DKK 1,577m cons.) and EBIT before non-recurring items of DKK 224m (vs. DKK 263m cons.), missing expectations on both topline and profitability. FY2025 guidance was maintained: organic growth of 11–14%, EBIT margin of 13–15%, and free cash flow of DKK +0.5bn.

Pandora (CPSE:PNDORA) reported Q1-2025 revenue of DKK 7,347m (vs. DKK 7,355m cons.), with organic growth of 7% (vs. 6.5% cons.) and EBIT of DKK 1,641m (vs. DKK 1,618m cons.). Strong momentum in the U.S. (+12% organic) helped offset macro headwinds. FY2025 organic growth guidance was reiterated at 7–8%, while the EBIT margin forecast was revised to “around 24%” (from ~24.5%) due to FX pressure. For 2026, Pandora now expects ~25% margin (vs. 26–27% under its original Phoenix plan), citing rising silver prices and increased trade risk exposure.

Maersk (CPSE:MAERSK B) beat expectations across the board in Q1-2025, reporting revenue of USD 13.2bn (vs. USD 12.9bn cons.), EBITDA of USD 2.71bn (vs. USD 2.44bn cons.), and EBIT of USD 1.25bn (vs. USD 916m cons.). Despite the strong start, the company reiterated FY2025 guidance (EBITDA: USD 6–9bn; EBIT: USD 0–3bn; FCF: ≥ USD -3bn) and revised its container volume outlook to -1 to -4%, citing mounting macro and geopolitical uncertainty. Management implied that results are now likely to land toward the lower end of the guided range.

Sweden

A similarly busy week in Stockholm, echoing previous week’s intensity. We were pleased to see largely positive performance in names flagged ahead of the week, particularly from Sinch (OM:SINCH), and Apotea (OM:APOTEA). The all-share index (-0.4%) and large-cap index (-0.6%) largely sidetracked for the week.

Q1-2025 marked the third quarter-streak of organic growth for Sinch (OM:SINCH), with +3% growth in organic net sales alongside a 2% organic increase in gross profit. Adj. EBITDA rose 8% y/y organically, beating consensus by 7%, driven by strength across all regions. Growth levers highlighted at its CMD — enterprise, self-serve, RCS, and partnerships — are all showing good traction. Large enterprise customer count rose 5%, and RCS volumes surged 50%.

Sinch posted strong cash generation (FCF/share at SEK 2.15) with net debt/EBITDA at just 1.4x, giving room for buybacks. The AGM mandate allows repurchases of up to 10% of shares, potentially lifting EPS CAGR from 9% to 12% through 2027E. Trading at 8x 2025E P/E with SEK 3.20 in adj. EPS, Sinch screens attractively vis-á-vis CPaaS peers, incl. Twilio and Link Mobility.

In the coming week, we track earnings from Catena Media (OM:CTM), Karnov (OM:KAR), Yubico (OM:YUBICO), and Synsam (OM:SYNSAM).

Earnings review & other relevant news

Apotea (OM:APOTEA) reported Q1-2025 revenue of SEK 1,754m (+15.2% YoY), with EBIT rising to SEK 92.4m (vs. SEK 62.2m LY). Operating margin improved to 5.3% (vs. 4.1%), driven by solid underlying demand and calendar effects. Gross margin ticked up to 27.7% (vs. 27.3%). The sales mix remained stable, with prescription drugs at 38.6% and OTC/merchandise at 59.1%.

Loomis (OM:LOOMIS) posted Q1-2025 EBITA of SEK 886m (vs. SEK 881m cons.) with a margin of 11.6% (vs. 11.4% cons.). Revenue came in slightly below expectations at SEK 7,665m (vs. SEK 7,703m cons.) with organic growth of 4.4% (vs. 5.1% cons.). Separately, Loomis announced the acquisition of U.S.-based Burroughs for USD 72m, expanding its North American equipment lifecycle services footprint.

Securitas (OM:SECU B) recorded Q1-2025 adj. EBITA of SEK 2,525m (vs. SEK 2,609m cons., SEK 2,357m LY) on organic sales growth of 3.0% to SEK 39.6bn (vs. SEK 40.8bn cons.). The company reiterated its 8% margin target by end-2025 and highlighted continued progress on its SEK 200m cost savings program. Critical Infrastructure remained a drag, with weak margins and a lost contract. Securitas also completed the divestment of its French airport operations during the quarter.

Ambea (OM:AMBEA) reported Q1-2025 revenue of SEK 3,644m (vs. SEK 3,626m cons.), with organic growth of 4%. Adj. EBITA rose to SEK 307m (vs. SEK 299m cons., SEK 279m LY), while reported EBITA was SEK 277m. EBIT increased to SEK 264m (vs. SEK 251m cons.), for a margin of 7.2%. The quarter included the opening of six new care accommodations and new lease signings for four more across Nytida and Stendi.

Attendo (OM:ATT) reported Q1-2025 EBITA of SEK 381m (vs. SEK 354m cons., SEK 292m LY), with an operating margin of 8.0%. Net sales rose to SEK 4,742m, driven by 1.6% organic growth and total growth of 8.1%. Free cash flow doubled to SEK 40m QoQ. Management reiterated confidence in reaching the 2026 EPS target of SEK 5.50. Occupancy remained stable at 86% across 21,091 beds.

Truecaller (OM:TRUE B) reported Q1-2025 revenue of SEK 497m (vs. SEK 512m cons.), with EBITDA of SEK 149m (vs. SEK 172m cons.) and EBIT of SEK 134m (vs. SEK 162m cons.). Results were weighed by increased incentive costs of SEK 50m (vs. SEK 30m in Q4), driven by recent share price gains. Sales rose 16% YoY, with regional growth led by MEA (+29%), RoW (+19%), and India (+14%). Monthly active users (ex-iOS) rose to 411.9m (+53m YoY).

Skanska (OM:SKA B) delivered Q1-2025 revenue of SEK 42.3bn (vs. SEK 39.1bn cons.), up 15% YoY adj. for FX, while EBIT came in at SEK 1,084m (vs. SEK 1,128m cons.). Construction EBIT margin improved to 2.8% (vs. 1.8% LY, in line with cons.). Order intake was SEK 39.3bn (vs. SEK 39.5bn cons.), bringing backlog to SEK 263.6bn (~19 months of production). U.S. construction outlook remains solid, while Nordic residential markets continue to soften.

Stillfront (OM:SF) has launched a strategic review of selected assets, aiming to divest or discontinue non-core operations to focus resources on more scalable growth opportunities. The company reported LTM revenue of SEK 6,543m and adj. EBITDA of SEK 2,274m for Q1-2025. Outcomes of the review will be communicated in due course.

Finland

It was a more muted week in Helsinki, with earnings landing broadly in line but without sparking much investor enthusiasm in either direction. After a flat start to the week, both the all-share (+0.7%) and large-cap (+0.8%) indices drifted upward late in the week.

Harvia delivered a solid Q1-2025, with revenue up +23% YoY (14% organic) and EBIT of EUR 11.9m, exactly in line with forecasts. Growth was broad-based but North America led the charge, where sales rose +59% (organic ~30%). EBIT came in at EUR 11.9m (vs. EUR 11.4m cons., EUR 9.9m LY), driven by fewer discounted campaign deliveries and prior price hikes — however, partly offset by higher OPEX as the company gears for future growth.

Strategically, the company stayed quiet on the outlook for Q2-2025, despite looming tariff risks in the U.S. that could weigh on sentiment. However, management did clarify that ~70% of North American products are manufactured locally, somewhat insulating the margins. Trading at 20x EV/EBIT (2025E), the valuation reflects its quality but exposes the stock to any slowdown in U.S. growth.

We’re heading into a yet another earnings week, with updates due from Aspo (HLSE:ASPO), Relais (HLSE:RELAIS), and KAMUX (HLSE:KAMUX), among others.

Earnings review & other relevant news

Kojamo (HLSE:KOJAMO) delivered FFO of EUR 23.3m for Q1-2025 (vs. EUR 22.6m cons., EUR 25.5m LY), slightly ahead of expectations. Net sales rose modestly, and net rental income outperformed forecasts. Full-year guidance was reiterated, with expected net sales growth of 1–4% in 2025.

Mandatum (HLSE:MANTA) reported Q1-2025 pre-tax profit of EUR 62.0m (vs. EUR 69.8m cons., EUR 46.9m LY), missing estimates despite investment results landing in line at EUR 51.8m. The group reiterated its outlook, expecting fee income to grow in 2025.

Nokian Renkaat (HLSE:TYRES) posted Q1-2025 adj. EBIT of EUR -18.5m (vs. EUR -6.0m cons.) and reported EBIT of EUR -35.9m (vs. EUR -16.0m cons.), missing sharply on profitability due to higher raw material and SG&A costs. Net sales came in at EUR 270m (vs. EUR 261m cons.), with comparable currency growth of +14.2%, outperforming regional markets.

Sampo (HLSE:SAMPO) reported a Q1-2025 underwriting profit of EUR 336m (vs. EUR 325m cons., EUR 260m LY), driven by mild weather and fewer large claims. The combined ratio improved to 84.6%, and net premium income rose to EUR 2.19bn, in line with expectations. The group raised full-year guidance, now targeting EUR 1.4–1.5bn in underwriting profit (prev. EUR 1.35–1.45bn) and premium income of EUR 8.8–9.1bn. Topdanmark synergy target was lifted to EUR 140m by 2028.

Etteplan (HLSE:ETTE) generated Q1-2025 revenue of EUR 94.9m (vs. EUR 97.1m cons., EUR 97.1m LY) and EBIT of EUR 4.2m (vs. EUR 6.0m cons., EUR 6.7m LY), both notably below expectations. EPS dropped to EUR 0.09 (vs. EUR 0.18 cons.). The company narrowed its FY2025 guidance within the prior range: revenue EUR 365–395m (prev. EUR 365–400m) and EBIT EUR 23–28m (prev. EUR 23–30m).

Outokumpu (HLSE:OUT1V) reported Q1-2025 adj. EBITDA of EUR 49m (vs. EUR 50.1m cons.), with net sales of EUR 1,524m (vs. EUR 1,513m cons.). The company guided for Q2 adj. EBITDA to be flat or slightly higher, falling short of consensus expectations for a stronger rebound. Stainless steel deliveries are expected to rise 0–10% QoQ, but Ferrochrome maintenance headwinds (~EUR -10m) will weigh on profitability.

Norway

Norway saw more dynamic newsflow vis-á-vis recent weeks. Alongside a packed earnings calendar, the OPEC+ production hike lifted tanker sentiment, while seafood stocks sold off on the back of fresh downgrades. That said, we’re pleased to see strong performance in names flagged ahead of the week. The all-share index (0.0%) and large-cap index (-0.5%) ended the week flat.

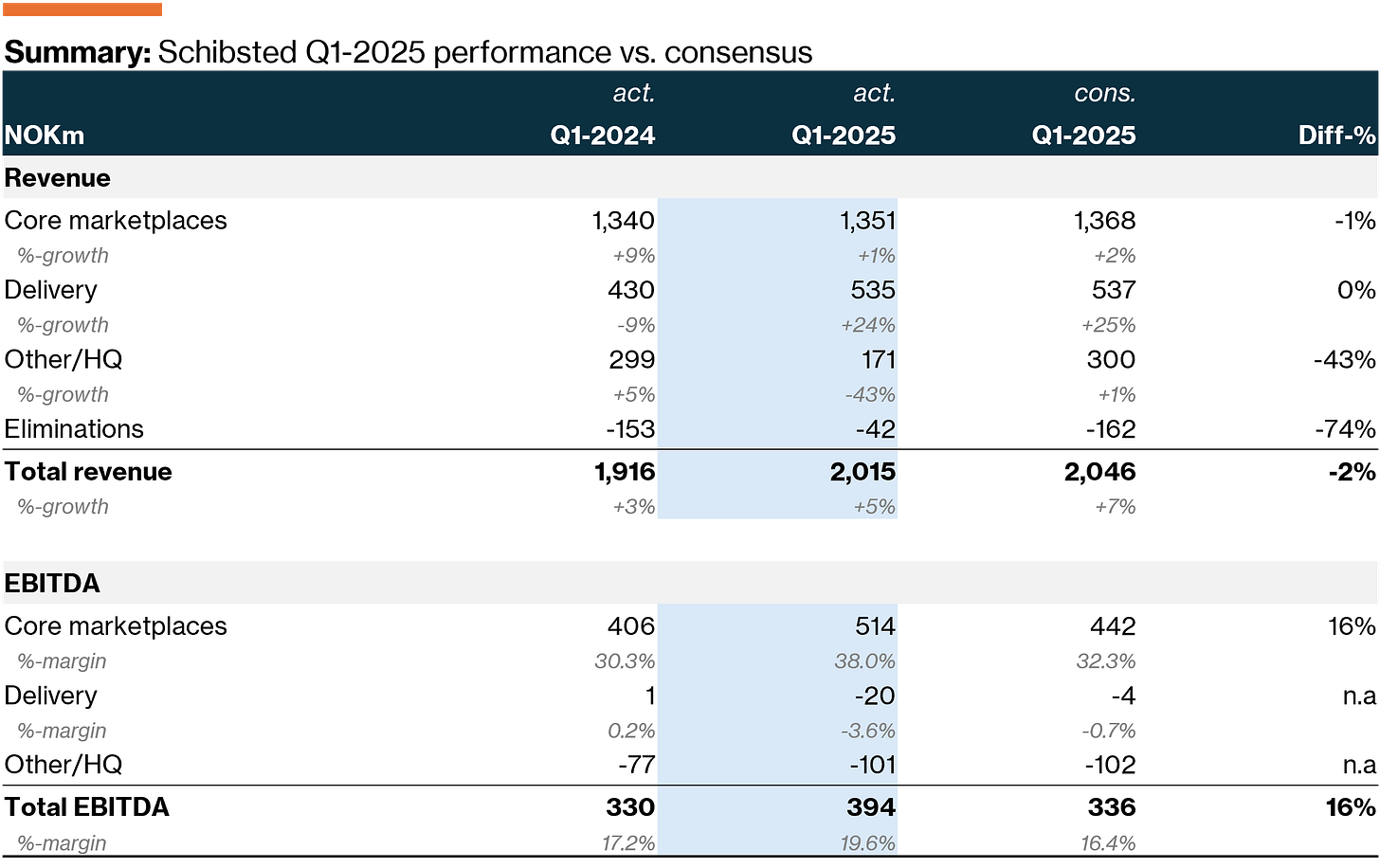

Schibsted (now rebranded as “Vend”) delivered a robust Q1-2025, with a 16% EBITDA beat vs consensus on largely flat revenues — driven by strong margin expansion in Classifieds. Real Estate led the upside, with revenue up 20% YoY, supported by higher ARPA and what management described as “exceptionally strong volumes in Norway,” though they caution volumes are “expected to normalize on a full-year basis.” With cost efficiencies gaining traction, we expect mid-single-digit upward revisions to FY2025E EBITDA, despite the lack of a formal guidance.

Strategically, Schibsted is actively reshaping its portfolio. It just announced the sale of Prisjakt to eEquity at ~4x EV/EBITDA (LTM), continuing the streamlining of non-core assets following recent buybacks. Trading at 23.7x EV/EBITDA (FY2025E) for +16% CAGR to 2027, expectations are full — but increasingly justifiable.

The coming week will be busy in Oslo, with earnings releases from a long list of names, including Mowi (OB:MOWI), Lerøy Seafood (OB:LSG), Hafnia (OB:HAFNI), Archer (OB:ARCH), Scana (OB:SCANA), and Cambi (OB:CAMBI).

Earnings review & other relevant news

Pexip (OB:PEXIP) reported Q1-2025 revenue of NOK 348m (vs. NOK 331m cons.), driven by a +10% YOY increase in ARR to USD 115.5m. EBITDA came in at NOK 115.1m (vs. NOK 87.7m cons.), reflecting a +13pp margin expansion, driven by operating leverage and FX tailwinds. Free cash flow more than doubled to NOK 221m. Growth was led by the Secure & Custom segment (ARR +27% y-o-y), supported by high-profile client wins (e.g., European Armed Forces). Management reaffirmed its “Rule of 40” ambition and introduced a share buyback of up to NOK 100m.

Telenor (OB:TEL) generated Q1-2025 revenue of NOK 19.7bn (vs. NOK 19.6bn cons.) and EBITDA of NOK 8.4bn (vs. NOK 8.6bn cons.), broadly in line. Pre-tax profit landed at NOK 3.8bn. Guidance for 2025 was reiterated, with low single-digit Nordic service revenue growth and low to mid-single-digit EBITDA growth expected. Growth remains price-driven, with average price hikes of 5–14%. The customer base rose by 600k to 84.8m, and active data usage edged up to 57%. Management reaffirmed its M&A appetite in core markets, eyeing upcoming EU deregulation.

Aker BP (OB:AKRBP) delivered Q1-2025 revenue of USD 3.2bn and EBIT of USD 1.9bn (vs. USD 2.08bn cons.), a slight miss on both lines. Despite the softer result, the company reaffirmed all guidance and capital return plans, including a USD 0.63/share dividend for the quarter. FY2025 production is still expected at 390–420k boe/day, underscoring operational stability amid a volatile commodity backdrop.

DNB (OB:DNB) reported a solid Q1-2025, with total revenue of NOK 21.9bn (vs. NOK 21.6bn cons.) and pre-tax profit of NOK 1.3bn from its brokerage arm, which will soon rebrand as DNB Carnegie. Net interest income (NOK 16.4bn) and commission income (NOK 3.5bn) both beat expectations, while credit losses were lower-than-feared at NOK 410m (vs. NOK 568m cons.). CET1 ratio stood at 18.5%, in line with estimates, underscoring a clean print across the board.

Kongsberg Gruppen (OB:KOG) delivered a blowout Q1-2025, crushing expectations across the board. Revenue came in at NOK 14,622m (vs. NOK 13,208m cons.), up 28% YoY, while EBITDA hit NOK 3,292m (vs. NOK 2,172m cons.), boosted by a NOK 1,048m one-off gain. EBIT reached NOK 2,892m and pre-tax profit NOK 2,916m. Order intake surged 63% YoY to NOK 20.7bn, driving a record backlog of NOK 134bn — with ~23% slated for 2025 delivery. Management reaffirmed its multi-year investment phase and sees strong momentum across both maritime and defense segments.

Wallenius Wilhelmsen (OB:WAWI) posted Q1-2025 EBITDA of USD 462m (vs. USD 486m cons., USD 438m LY), a modest YoY improvement but shy of expectations. Pre-tax profit rose to USD 267m (vs. USD 234m LY), and the company expects a stronger Q2-2025 sequentially. That said, full-year guidance was narrowed, with adj. EBITDA now expected to be in line with 2024, vs. prior guidance of flat to +10% YoY. While trade volumes remain healthy, US trade tensions and tariff risks continue to loom over the company’s global logistics exposure.

Hexagon Purus (OB:HPUR) reported Q1-2025 revenue of NOK 230m, marking a 44% YoY decline, driven by deteriorating demand visibility and market uncertainty tied to US policy shifts. EBIT came in at NOK -304m and cash balance ended at NOK 794m, falling short of expectations and raising liquidity concerns. Management cited the "significant market uncertainty" created by the new US administration as a key factor behind the weak quarter.

I agree with Joel, these weekly summaries are excellent!

Tack! Really appreciate this round-up. Have a great week.