Markets closed the week higher as a walk-back in rhetoric from U.S. President Trump triggered a relief rally. The softened tone addressed both tariff threats and earlier comments regarding the potential removal of Fed Chair Jerome Powell.

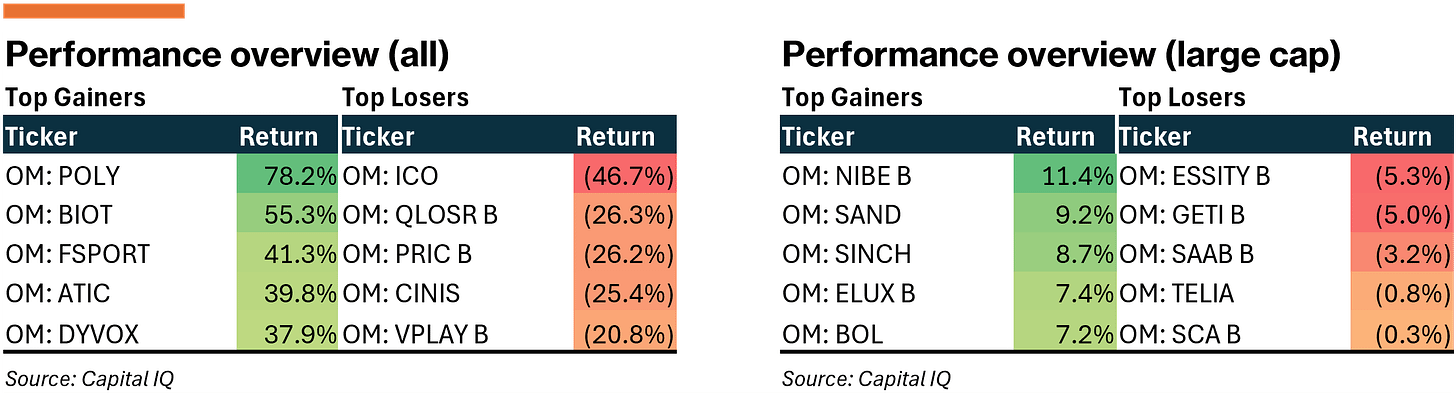

In the Nordics, markets tracked the global sentiment with the all-share index ending the week +2.2% higher. Tariff-exposed companies led the advance, though gains were partially offset by mixed results from the first major wave of Q1-2025 earnings releases; a selection of which we cover below.

Denmark

Despite limited corporate-related news, performance in Denmark was marked by a strong rebound in companies most affected by the U.S. tariff scare. The all-share index ended the week slightly lower (-0.6%), while the large-cap index continued to recoup recent losses (+1.4%).

Ahead of the week, we flagged the risk of a pullback in Novo Nordisk (CPSE:NOVO B) following Eli Lilly’s update on its pill-based obesity candidate, orforglipron. Novo shares did retreat in post-Easter trading but recovered after the company confirmed it is seeking FDA approval for its own oral obesity drug, 50mg semaglutide, which had already shown an average weight loss of 15.1% (vs. 7.9% for orforglipron) over 68 weeks in Phase 3 trials completed in 2023. The delay in submission was attributed to manufacturing complexity and raw material constraints, though the timing raised questions.

While earnings reports were limited this week, attention is turning to upcoming trading updates. We are particularly focused on A&O Johansen (CPSE:AOJ B), DSV (CPSE:DSV), and the breweries Carlsberg (CPSE:CARL B) and Royal Unibrew (CPSE:RBREW).

Other relevant news:

ALK-Abelló (CPSE:ALK B) announced that its pediatric application for Itulazax — a tablet for tree pollen allergy — has been approved by health authorities in 17 EU countries. Initial market launches are expected in the coming months, ahead of the 2025/2026 allergy season. Itulazax is already approved for adults in 22 countries, with similar pediatric reviews underway in Canada, Switzerland, and the UK. The approval marks the completion of ALK’s decade-long effort to cover the five most common respiratory allergies across all age groups. The company does not expect the approval to impact its 2025 financial guidance of 9–13% topline growth and a 25% EBIT margin.

Boozt (CPSE:BOOZT | OM:BOOZT) reported Q1-2025 results broadly in line with expectations but lowered its full-year outlook due to end-market uncertainty and FX headwinds. Net sales came in at SEK 1,652m (vs. SEK 1,653m cons.). Adj. EBIT landed at SEK 38m (vs. SEK 30.2m cons.), resulting in an EBIT margin of 2.3% (vs. 1.8% cons.). The company lowered its 2025 sales growth guidance to 0–6% (from 4–9%) and its adjusted EBIT margin in the range 4.5–5.5% (from 5.8–6.5%). Despite the revision, Boozt remains the most profitable player among its peers.

Sweden

It was a busy week in Stockholm as the first batch of Q1-2025 earnings hit the market. Positive earnings revisions, supported by broader macro conditions, fueled a broad-based rally, with the all-share index (+3.4%) and the large-cap index (+3.0%) moving higher in near lockstep.

Notably, the week featured yet another take-private offer, with U.S.-based private equity firm KKR seeking to acquire Biotage (OM:BIOT), a Sweden-based life sciences company. The offer is priced at SEK 145/share, valuing Biotage at SEK 11.6bn — a ~60% premium to its prior-day closing price. Major shareholders (~19%) have expressed support for the offer, and Gamma Biosciences (~17% stake and controlled by KKR) has committed not to accept competing offers. For Q1-2025 (LTM), Biotage reported revenues of SEK 1.96bn and adj. EBITDA of SEK 471m. With a net debt of SEK 434m, the transaction implies an EV of ~SEK 12bn (equiv. EV/EBITDA of 25.5x).

Getinge (OM:GETI B) became the first large-cap company in Sweden to report Q1-2025 results following the Easter break. The company grew topline +10.7% YoY (+7.2% organic) to SEK 8,320m, beating expectations (SEK 8,219m cons.). However, it missed on order intake and profitability. Order intake came in at SEK 8,632m (vs. SEK 8,762m cons.) and adjusted EBITA landed at SEK 1,003m (vs. SEK 1,021m cons.). Free cash flow fell sharply to SEK 160m, down from SEK 944m SPLY, primarily due to higher inventory levels and increased restructuring costs.

Unsurprisingly, questions around tariff impacts dominated the earnings call. However, the company declined to quantify potential headwinds, citing the complexity and uncertainty around the evolving tariff situation. Having said that, the company did disclose production origin as a share of sales in the U.S., EU, and China, noting that ~60% of U.S. sales are produced domestically.

Our worst-case, back-of-the-envelope calculations suggest an added expense headwind of ~SEK 1bn tied to the tariff situation, implying an EBITA hit of ~21% relative to FY2024A EBITA. We remain on the sidelines for now, given more attractive opportunities available elsewhere.

Next week looks similarly active, with Q1-2025 results due from, inter alia, Swedish Orphan Biovitrum (OM:SOBI), Engcon (OM:ENGCON B), online betting operators Betsson (OM:BETS B) and Kambi (OM:KAMBI), as well as newly listed Asker Healthcare (OM:ASKER).

Earnings review & other relevant news:

Sandvik (OM:SAND) announced a record SEK 750m order from South32 for battery-electric equipment to support the greenfield Hermosa project in Arizona, USA — the only advanced mine development in the U.S. positioned to produce critical minerals such as manganese and zinc. The order, booked in Q2-2025, is Sandvik’s largest to date for battery-electric vehicles and includes electric trucks, loaders, drill rigs, and conventional support vehicles. Deliveries are expected to begin in Q4-2026 and continue through 2030.

Analysts are touting Spotify (NYSE:SPOT) as a potential acquirer of Storytel (OM:STORY B) to strengthen its audiobook offering, particularly in the Nordic market. The speculation follows Storytel’s financial recovery and the recent exit of EQT from its shareholder base. Storytel is a leading audiobook streaming service with a strong catalog and dominant Nordic market position.

Assa Abloy (OM:ASSA B) posted Q1-2025 sales of SEK 37,940m, up 8% YoY (+2% organic), slightly ahead of expectations (SEK 37,557m cons.). Adjusted EBIT came in at SEK 5,645m (vs. SEK 5,613m cons.). Operating cash flow fell 22% YoY to SEK 2,424m, impacted by inventory buildup ahead of potential tariffs. The U.S. remains Assa Abloy’s largest market, accounting for ~47% of FY2024A sales.

Beijer Ref (OM:BEIJ B) delivered a solid Q1-2025, with net sales of SEK 8,898m, slightly ahead of expectations (SEK 8,770m cons.). Organic growth turned positive at +4.3% (vs. -4.1% LY). EBIT came in at SEK 778m (vs. SEK 740m cons.), while EBITA reached SEK 832m (vs. SEK 794m cons.).

Addnode (OM:ANOD B) reported a weak Q1-2025, with net sales down 39.4% YoY to SEK 1,461m (-41% organic), driven by Autodesk’s shift in revenue recognition. Adjusted for the previous reseller model, net sales would have been SEK 2,507m with organic growth of ~3% on a constant-currency basis. EBIT fell to SEK 149m (vs. SEK 187m LY). Management cited continued macro and geopolitical uncertainty affecting customer investment decisions.

Viaplay (OM:VPLAY B) reported Q1-2025 revenue of SEK 4,374m, with core business revenue declining organically by 4.8% YoY. The operating loss for core operations (pre-associates and items affecting comparability) was SEK -222m, an improvement from SEK -270m SPLY. Streaming subscription revenue grew organically by 1%, driven by price increases and favorable mix, though the total number of subscribers fell 4.1% to 4.65m.

CDON (OM:CDON) posted Q1-2025 results showing a 16% decline in sales YoY, alongside an operating loss, including a significant write-down linked to the 2023 merger with Fyndiq. In response, the board has launched a strategic review exploring options including a sale, capital raise, or other alternatives. Notably, U.S.-based Nantahala acquired a significant minority stake in late 2024.

Finland

Finland was similarly active as a wave of mixed Q1-2025 results hit the market. The all-share index (+1.7%) and the large-cap index (+1.6%) both edged into positive territory for the year. Separately, the Finnish government announced initial preparations for a new tax reform aimed at lowering the corporate tax rate by 2pp to 18%.

Finnish pharmaceutical group Orion delivered a stronger-than-expected Q1-2025, reporting net sales of EUR 354.6m (EUR 340.0m cons.) and EBIT of EUR 77.9m (EUR 67.6m cons.). Growth was driven primarily by Nubeqa, which expanded 85% YoY, alongside solid performance from branded products and generics. Management reiterated full-year 2025 guidance, maintaining revenues between EUR 1,550–1,650m alongside EBIT in range of EUR 350–450m.

The company also highlighted the addition of a new Phase III pipeline candidate — an oral formulation of levosimendan — though it remains too early for inclusion in forecasts. Despite a strong quarter, valuation remains elevated relative to peers, with Orion trading at ~18x EV/EBIT for 2025E, a 37% premium to large-cap comparables. In addition, the company remains exposed to potential downside from U.S. tariffs, particularly within its generics segment, as discussed in our recent piece, Patents, Pills, and Protectionism: The Effects of U.S. Tariffs on the Nordic Pharmaceutical Industry.

In the week ahead, we are monitoring earnings from the legacy Cargotec companies Kalmar (HLSE:KALMAR) and HIAB (HLSE:HIAB), as well as Tietoevry (HLSE:TIETO) and Kone (HLSE:KNEBV), among others.

Earnings review & other relevant news:

Konecranes (HLSE:KCR) announced an order from GCT Global Container Terminals for ten hybrid RTG cranes and one battery-powered RTG crane in Canada. The value of the order was not disclosed.

Qt Group (HLSE:QTCOM) issued a profit warning just one day ahead of its scheduled Q1-2025 results, citing sluggish growth and weaker profitability for the quarter. Management now guides for 10–20% revenue growth with an EBITA margin of 30–40%.

Valmet (HLSE:VALMT) delivered Q1-2025 results slightly below expectations on the topline, with net sales of EUR 1,184m (vs. EUR 1,194m cons.). Comparable EBITA landed at EUR 121m, in line with last year and consensus estimates. Order intake was a clear positive, rising to EUR 1,332m (vs. EUR 1,204m cons.), driven by strength in pulp and paper. Full-year guidance was reiterated, with revenue and comparable EBITA expected to match FY2024A levels at EUR 5,359m and EUR 609m, respectively.

Verkkokauppa.com (HLSE:VERK) posted a strong Q1-2025 beat, with net sales of EUR 110.5m, up +2.4% year-over-year and slightly ahead of last year. Comparable EBIT reached EUR 3.2m (vs. EUR 1.0m cons. and EUR 0.5m LY), materially outperforming expectations. Management pointed to a recovery in key categories — particularly entertainment and IT — supported by targeted commercial efforts.

Metso (HLSE:METSO) saw softer Q1-2025 results, with net sales of EUR 1,173m falling short of expectations (EUR 1,235m cons.). Adjusted EBITA came in at EUR 193m (vs. EUR 203m cons.). Order intake was a relative bright spot, reaching EUR 1,413m and exceeding the EUR 1,363m consensus estimate.

Ponsse (HLSE:PON1V) outperformed in Q1-2025, posting net sales of EUR 185.4m (vs. EUR 173.5m cons.), up from EUR 169.7m a year ago. EBIT surged to EUR 13.2m (vs. EUR 8.2m cons.), a sharp improvement from EUR ~1.2m LY. The order backlog, however, declined to EUR 187.7m (from EUR 226.0m). Management maintained guidance, expecting EBIT to be slightly higher than the EUR ~36.8m reported in FY2024A.

Norway

In Oslo, the all-share index (+0.3%) and large-cap index (+0.8%) posted modest gains as investors weighed earnings and corporate actions. REC Silicon (OB:RECSI) — a supplier of advanced silicon materials for solar and electronics — received a takeover offer of NOK 2.20/share from its largest shareholder, Hanwha Group. The offer represents a +28% premium to the prior-day close, and values the company at an EV of NOK ~5.16bn (EBITDA negative).

Norwegian chemical company, Yara (OB:YAR) delivered a strong Q1-2025 result, materially exceeding expectations. Adj. EBITDA landed at USD 638m, +23% ahead of consensus, driven by higher volumes (USD +60m) and pricing efforts (USD +70m).

Operational momentum was evident beyond the headline numbers. European deliveries rose 5% YoY, premium product sales strengthened, and fixed costs declined by USD 34m, lifting margins to 15.5% (+1.1pp vs cons.). Looking ahead, the company expects Q2 gas prices to be USD 140m lower YoY, supporting further margin resilience, though potentially offset by incremental Chinese supply.

Next week features a full slate of earnings, though we remain focused on results from Zalaris (OB:ZAL), Frontline (OB:FRO), and Atea (OB:ATEA).

Earnings review & other relevant news:

Kistefos AS, the investment company controlled by Norwegian industrialist and investor Christen Sveaas, flagged a reduction in its ownership of Vow (OB:VOW) below the 5% threshold, now holding ~4.74%. Vow specializes in technologies that convert waste and biomass into valuable resources and clean energy.

AutoStore (OB:AUTO) reported Q1-2025 results, missing across the board. Revenue came in at USD 85.9m, down 37.8% YoY and 47.9% QoQ, well below analyst expectations (USD 139m cons.). Adjusted EBITDA landed at USD 21.1m (vs. USD 62m cons.). Order intake was also soft at USD 141.2m, down 22.8% YoY (down 1.8% QoQ), and below the consensus estimate of USD 151.3m.

Kitron (OB:KIT) posted Q1-2025 revenue of EUR 164.6m, down -5.3% YoY, missing consensus expectations of EUR 170m. Despite the revenue decline, EBIT reached EUR 12.5m, surpassing the EUR 11.5m consensus estimate. The company also reported a strong order intake of EUR 524.8m (+17.9% YoY), exceeding the expected EUR 500m.

Höegh Autoliners (OB:HAUTO) delivered Q1-2025 revenue of USD 329m, flat YoY and broadly in line with expectations. Adj. EBITDA came in at USD 155m (vs. USD 161m cons.), weighed down by lower volumes and a reduction in average freight rates. Contract coverage increased to 82%, supported by two new long-term agreements. Management expects Q2-2025 performance to be broadly in line with Q1-2025, while flagging risks from new U.S. tariffs, port fees, and continued Red Sea disruptions. The company declared a Q1 dividend of USD 158m (USD ~0.83/share).

Thanks for this, really appreciate the rundown. Have a great week.