After months of geopolitical headline fatigue, week 18 offered a brief reprieve — until Friday, when Beijing said it was “evaluating” overtures from Washington on restarting trade talks. Markets welcomed the thaw, helping risk sentiment close the week on a firmer footing. More crucially, the Q1-2025 earnings season got into full swing, with a flurry of Nordic corporates delivering results. Moves were sharp in both directions, but the balance leaned positive with the Nordic all-share index gaining +3.2% for the week.

On the macro front, Eurozone inflation came in at 2.2% for April, a touch above expectations and a reminder that the ECB’s path to rate cuts is still lined with caveats. Traders continue to price in an ~85% probability of a 25bp cut in June, with two or three cuts expected by year-end.

Denmark

Week 18 delivered a strong rebound to both the all-share index (+7.9%) and large-cap index (+6.3%) were both lifted select by big moves, despite guidance cuts and consensus beats arriving in near equal measure.

DSV (CPSE:DSV) delivered a solid Q1-2025 with Group EBIT +1% ahead of consensus, largely driven by stronger yields in Sea & Air (+2% vs. cons.) — partially offset by Road (-2% vs. cons.) and Solutions (-8% vs. cons.). The real surprise came in guidance: DSV raised FY2025 EBIT to DKK 19.5–21.5bn, a big leg up vis-á-vis the initial guide of DKK 15.5–17bn — driven by stronger than anticipated synergies from the Schenker acquisition.

DSV now expects DKK 9bn in synergies from Schenker by 2028, well above the ~DKK 7.5bn consensus range. Transaction and restructuring costs are pegged at DKK 11bn, with DKK 2.0–2.5bn expected this year alone. Management assumes a baseline EBIT from Schenker of DKK ~6bn — significantly below the EUR 1.1bn it reported in 2024 — implying meaningful upside baked into the integration case. While we’re optimistic on the company, it is worth noting the company trades at material premium to peers.

In the week to come, we’re watching earnings from Danish pharma heavyweights, including Novo Nordisk (CPSE:NOVO B), Genmab (CPSE:GMAB), Bavarian Nordic (CPSE:BAVA), and Zealand Pharma (CPSE:ZEAL). We’re also looking for potentially valuable signals on future expectations from DFDS (CPSE:DFDS) — given its poor execution in recent years — and Columbus (CPSE:COLUM) which is exploring a potential sale.

Earnings review & other relevant news

Novo Nordisk (CPSE:NOVO B) shares climbed after securing a major distribution win with CVS Caremark who has named Wegovy its preferred weight-loss drug, displacing Eli Lilly’s Zepbound. Separately, Novo announced that Wegovy showed meaningful reductions in fatty liver disease, prompting the FDA to grant expedited review for that additional indication — potentially shortening approval time from 10 to 6 months. The twin headlines sent Eli Lilly’s shares down 11.7% despite delivering a strong Q1-2025.

Coloplast (CPSE:COLO B) lowered its FY2025 guidance, now expecting ~7% organic growth (vs. prior 8–9%) and an EBIT margin of 27–28% (vs. ~28% previously). The downgrade was attributed primarily to weaker demand in China, where spending momentum has slowed materially.

GN Store Nord (CPSE:GN) issued a profit warning alongside Q1-2025 results, as revenue dropped 7% YoY to DKK 3,980m (vs. DKK 4,200m cons.), while EBITDA fell sharply to DKK 300m (vs. DKK 509m cons.), a 44% decline YoY. Net profit was just DKK 89m (vs. DKK 206m cons.). The company cut its FY2025 organic growth guidance to -3% to +3% (from 3–7%) and lowered expected EBITA margin to 11–13% (from 12–14%). Weakness was linked to production disruption in China amid rising U.S. tariffs, prompting GN to initiate a geographic shift in supply chains toward Southeast Asia. Shares are down 37% YTD and 57% LTM.

Carlsberg (CPSE:CARL B) reported Q1-2025 revenue of DKK 20,123m, below consensus (DKK 20,382m cons.), with organic growth at -1.5% (vs. -1.0% cons.) and volume down 2.3%. Miss was driven by softer trends in Asia and Central & Eastern Europe, partly offset by better-than-expected Western Europe volumes (-3.1% vs. -4.7% cons.). China volumes grew low-single digits, outperforming a declining market. Britvic volumes fell 4.1% in Q1 due to portfolio pruning, though integration remains on track. FY25 guidance for organic EBIT growth of +1–5% was reiterated, despite a ~DKK 200m FX headwind to EBIT (vs. prior tailwind). No guidance uplift or earnings beat led to muted share reaction, with expectations unchanged after a strong YTD rally (+31%). With shares +31% YTD vs +2% for the sector, Carlsberg trades on 13.6x 2026 P/E; a 13% discount to European Beverages on 15.8x.

Danske Bank (CPSE:DANSKE) delivered Q1-2025 PBT of DKK 7,591m (vs. DKK 7,088m cons.), beating across key lines. Net interest income reached DKK 9,020m (vs. DKK 8,893m cons.), net commission income came in at DKK 3,658m (vs. DKK 3,576m cons.), and net trading income also surprised positively at DKK 882m (vs. DKK 736m cons.). Total revenue stood at DKK 13,931m (vs. DKK 13,660m cons.), while net credit losses were only DKK 50m — well below expectations (DKK 196m cons.). Net profit was DKK 5,757m, translating to EPS of DKK 6.90 (vs. DKK 6.16 cons.). CET1 capital ratio ended at 18.4% (vs. 17.8% cons.), offering further buffer strength. Solid beat across the board with credit quality and capital metrics better than expected.

Boozt (CPSE:BOOZT | OM:BOOZT) announced a SEK 200m share buyback program following last week’s guidance cut and sharp share price decline. The program is part of a previously communicated SEK 800m three-year buyback plan, of which SEK 385m had been executed prior. Separately, Ferd — Boozt’s second-largest shareholder — acquired 1.2 million shares at prices between SEK 81.82 and 84.34, according to filings.

Sweden

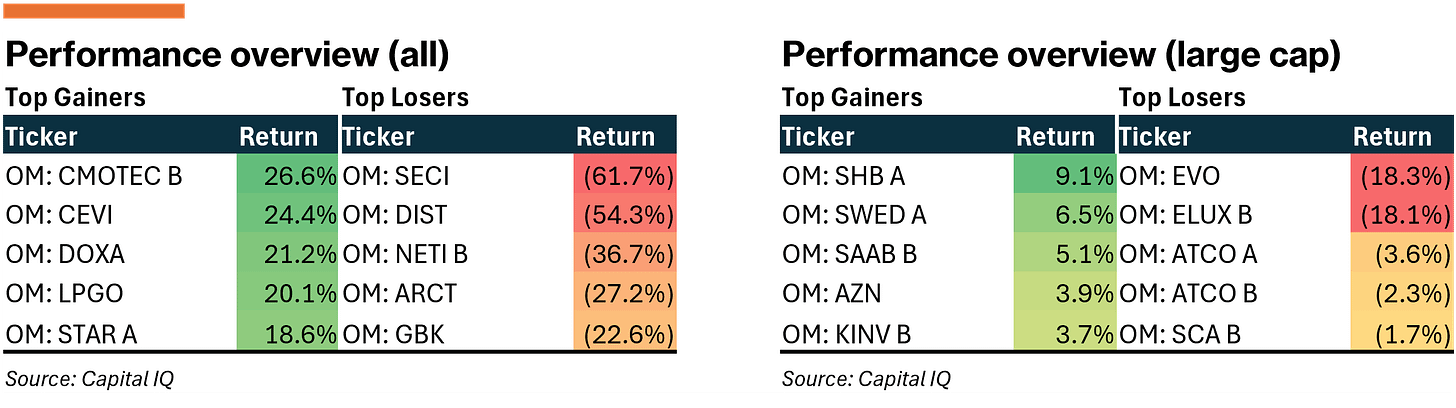

Busy week in Stockholm, with a flood of new earnings reports and more than a few surprises — both upside and downside. The OMX Stockholm all-share index (+1.3%) and large-cap index (+0.7%) both ended the week higher. We were particularly happy with the earnings from AstraZeneca (OM:AZN) and SOBI (OM:SOBI) — both names we flagged as favorites in the wake of Trump's tariff theatrics.

SOBI reported Q1-2025 sales of SEK 6,456m, a 3.3% beat vs. consensus and up 3% YoY in constant currency. Key outperformers included Altuvoc and Gamifant, with the latter benefiting from better patient mix. Adj. EBITA was SEK 2,352m (+14% vs. consensus), equivalent to a 36.4% margin (vs. 33.0% cons.).

We are less excited to see recently acquired Vonjo (part of CTI acquisition) revenues down 11.8% YoY and ~29% below consensus — hurt by inventory effects and Medicare Part D related discounting. Given that CTI was SOBI’s largest acquisition (USD ~1.7bn), the post-deal softness is will be a key item to watch out for in coming quarters. Nonetheless, SOBI currently trades at 8.8x 2025E EV/EBITDA which we deem attractive in light of its 2025E-27E sales CAGR of 13%.

The coming week is set to be equally busy. We are on the watch for earnings from Loomis (OM:LOOMIS), Securitas (OM:SECU B), Sinch (OM:SINCH), and Apotea (OM:APOTEA).

Earnings review & other relevant news

Evolution (OM:EVO) reported Q1-2025 revenue of EUR 521m (vs. EUR 545m cons.), missing broadly across the board. EBITDA came in at EUR 342m (vs. EUR 365m cons.), with a margin of 65.6% (vs. 66.9% cons.). The miss was partly attributed to cyber-related disruptions in Asia, where the company is deploying technical countermeasures. CEO Carlesund acknowledged dissatisfaction with the quarter’s performance but reiterated the FY2025E EBITDA margin guidance of 66–68%. Shares fell ~17% — the stock’s worst trading day since its 2015 IPO.

Betsson (OM:BETS B) generated Q1-2025 revenue of EUR 294m (vs. EUR 291m cons.), driven by casino revenue of EUR 212m (vs. EUR 209m cons.) and sportsbook revenue in line at EUR 79.7m. EBITDA missed slightly at EUR 77.7m (vs. EUR 79.1m cons.). Sportsbook margin improved to 8.0% (vs. 6.6% LY, but down from 9.8% Q4-2024), reflecting more normalized betting behavior. Active customers grew 7% YoY to 1.37m. Management highlighted that early Q2-2025 trends look strong, with average daily revenue through April 27 at +21.7% YoY.

AstraZeneca (OM:AZN) posted Q1-2025 revenue of USD 13.6bn, up 10% YoY but 2% below consensus (USD 13.7bn cons.). Core EPS came out strong at USD 2.49 (vs. USD 2.24 cons.), supported by stronger gross margin, lower SG&A, and a one-off tax benefit. Core EBIT landed at USD 4.8bn, 2% ahead of expectations, with a margin of 35.3%. FY2025 guidance for high-single-digit revenue and low-single-digit EPS growth was reiterated. Pipeline momentum continues with five positive Phase 3 studies and 13 new approvals.

Electrolux (OM:ELUX B) reported Q1-2025 net sales of SEK 32,576m (vs. SEK 31,921m cons.), with organic growth of 7.9% YoY. EBIT came in at SEK 452m (vs. SEK 610m cons.), yielding a margin of 1.4% (vs. 1.9% cons.). Operating cash flow was negative SEK 3.1bn, in line with seasonal trends. The North America market outlook was revised amid rising U.S. trade policy uncertainty. The company now expects a “significantly negative” impact from external factors (tariffs, FX, input costs), though price/mix is expected to offset some of the pressure. FY2025 guidance for SEK 3.5–4.0bn reiterated.

Balco (OM:BALCO) released weak Q1-2025 results, with organic sales down 10% YoY to SEK 316m and order intake falling to SEK 275m (vs. SEK 352m in Q4). The decline was driven by a sharp drop in renovation orders (SEK 208m vs. SEK 285m), while new construction held steady at SEK 67m. In response, the company announced a SEK 60m cost savings program to adjust its cost base. Management pointed to an unfavorable project mix vs. SPLY and slower demand in renovation as key headwinds.

Finland

The industrial-heavy OMX Helsinki all-share and large-cap indexes both rose +3.5% on the week. Ahead of the week, we flagged earnings from Kone (HLSE:KNEBV), Kalmar (HLSE:KALMAR), Hiab (HLSE:HIAB) and Tietoevry (HLSE:TIETO) — and we were pleased to see solid execution across the board.

Kone (HLSE:KNEBV) delivered a clean Q1-2025 print with adj. EBIT of EUR 280m (vs. EUR 283m cons.), on net sales of EUR 2,672m (vs. EUR 2,676m cons.). Slight misses on top line and profitability were offset by a better-than-expected order intake of EUR 2,378m (vs. EUR 2,315m cons.). The service segment remained a key bright spot — maintenance sales grew 8.5% YoY in constant currency, with >10% growth ex-China, and pricing driving roughly half of the uplift.

Management flagged a slightly weaker outlook for North America, citing increased uncertainty, while Central Europe is seeing early improvement. China (23% of FY2024A sales) remains a drag, but early signs of stabilization are emerging in Tier 1–2 cities. Meanwhile, services and modernisation remain robust, providing margin ballast. Guidance for 2025 was reiterated: +1–6% sales growth in constant currency and 11.8–12.4% EBIT margin. Current consensus sits right near the midpoint.

For the coming week, we are keeping an eye on earnings from Sampo (HLSE:SAMPO), Nokian Renkaat (HLSE:TYRES), Kojamo (HLSE:KOJAMO), and Harvia (HLSE:HARVIA).

Earnings review & other relevant news

Neste (HLSE:NESTE) reported Q1-2025 net sales of EUR 5,017m (vs. EUR 5,140m cons.), slightly below expectations. Group EBITDA came in at EUR 210m (vs. EUR 212m cons.), with a lower-than-expected performance in Oil Products at EUR 120m (vs. EUR 163m cons.) but clear beat in Renewable Products at EUR 72m (vs. EUR 31m cons.) driven by stronger margins (USD 310/t vs. USD 242/t cons.). Clean net income was EUR -32m (vs. EUR -58m cons.). The company reiterated FY guidance, noting limited direct U.S. tariff impact, while also adjusting Singapore exports due to the ongoing lapse of the U.S. Blender’s Tax Credit. Capex guidance set at EUR 1.1–1.3bn for FY2025.

Hiab (HLSE:HIAB) outperformed on margins, posting EBIT of EUR 65.7m (vs. EUR 52.2m cons.) and a 16.0% EBIT margin (vs. 13.4% cons.), reflecting disciplined cost control. Order intake came in at EUR 378m (vs. EUR 394m cons.), down 2% YoY. Despite the top-line softness, FY margin guidance was reaffirmed, with expectations to exceed 12.0% (ex-items affecting comparability).

Kalmar (OM:KALMAR) reported Q1-2025 net sales of EUR 398m (vs. EUR 406m cons., EUR 439m LY), reflecting lower equipment deliveries after a strong prior-year comp. Mix-shift continued in favor of higher-margin service sales. Comparable EBIT came in at EUR 48m (vs. EUR 52.2m cons., EUR 53.9m LY), with an EBIT margin of 12.0%. Order intake rose 19% YoY to EUR 480m (vs. EUR 421m cons.), driven by strong equipment demand. Backlog increased to EUR 1,041m (vs. EUR 972m LY). Full-year guidance was reiterated, with EBIT margin expected to exceed 12%.

Fifax (HLSE:FIFAX) shares fell retracted after the company issued a liquidity warning tied to overdue receivables. Its sole major customer has failed to meet agreed payment obligations, leading to a material deterioration in working capital and liquidity. Fifax is currently in negotiations to recover the overdue amounts but flagged that the situation presents a near-term cash flow risk.

Norway

Both the Oslo all-share index and large-cap index gained ~2.4% for the week, lifted by improved sentiment in beaten-down stocks following Trumps tariff scare — aided by decent earnings reports for select companies.

The week also featured a takeover attempt, as Electric AS — a newly formed vehicle backed by Geveran Trading, Wilhelmsen New Energy, and EPS Ventures — launched an unconditional cash offer for Edda Wind (OM:EWIND) at NOK 23.00/share, valuing the offshore wind vessel operator at ~NOK 2.97bn. The bid represents a substantial premium to recent trading levels and aims to resolve Edda’s concentrated ownership and thin liquidity. With FY2024A revenue of EUR 70.4m and EBITDA of EUR 19.1m, the company had struggled to attract public-market interest despite exposure to a structurally growing segment.

Next week we are paying particular attention to earnings from the likes of DNB (OB:DNB), Aker (OB:AKER), Pexip (OB:PEXIP), and Itera (OB:ITERA).

Earnings review & other relevant news

Nordic Semiconductor (OB:NOD) delivered Q1 revenue of USD 155.1m (vs. USD 150.4m cons.), more than doubling YoY. EBITDA of USD 14.7m (vs. USD 14.5m cons.) was slightly ahead, but pre-tax profit missed at USD 2.0m (vs. USD 4.6m cons.).

Nel (OB:NEL) posted a sharp YoY revenue drop to NOK 155m (vs. NOK 267m cons., NOK 276m LY), missing consensus by a wide margin. EBITDA landed at NOK -115m (vs. NOK -78m cons.), and pre-tax profit deteriorated to NOK -180m (vs. NOK -123m cons.). Order intake fell 22% YoY, bringing the backlog to NOK 1.46bn. A March tie-up with Samsung E&A briefly lifted sentiment, but the stock remains down ~50% YoY.

Atea (OB:ATEA) saw Q1 revenue rise ~17% YoY to NOK 13.3bn (vs. NOK 11.4bn LY), reflecting continued strength in Nordic IT infrastructure. Pre-tax profit declined to NOK 209m (vs. NOK 245m LY) on margin pressure, though management struck a positive tone on demand outlook.

Norsk Hydro (OB:NHY) posted revenue of NOK 57.1bn (vs. NOK 57.07bn cons., NOK 47.6bn LY), supported by higher aluminum prices and FX tailwinds. Adj. EBITDA came in at NOK 9.52bn (vs. NOK 9.86bn cons.) and pre-tax profit reached NOK 7.0bn (vs. NOK 7.25bn cons.). Net income after minorities surged to NOK 4.83bn (vs. NOK 941m LY), with aluminum priced at USD 2,547/ton (vs. USD 2,248/ton LY).

Subsea 7 (OB:SUBC) delivered a top-line beat with Q1 revenue at USD 1.53bn (vs. USD 1.45bn cons., USD 1.4bn LY). Adj. EBITDA of USD 236m (vs. USD 227m cons.) showed strong YoY growth, while pre-tax profit of USD 32m (vs. USD 19m cons., USD 55m LY) came in ahead of expectations despite being down YoY.