The political theatre has returned. Trump kicked off the week threatening to cut U.S. drug prices by up to 90% — a rehash from his first term and equally implausible now. Meanwhile, geopolitical sentiment turned oddly constructive following optimism around a U.S.–China trade agreement and surface-level progression in peace-talks between Russia and Ukraine.

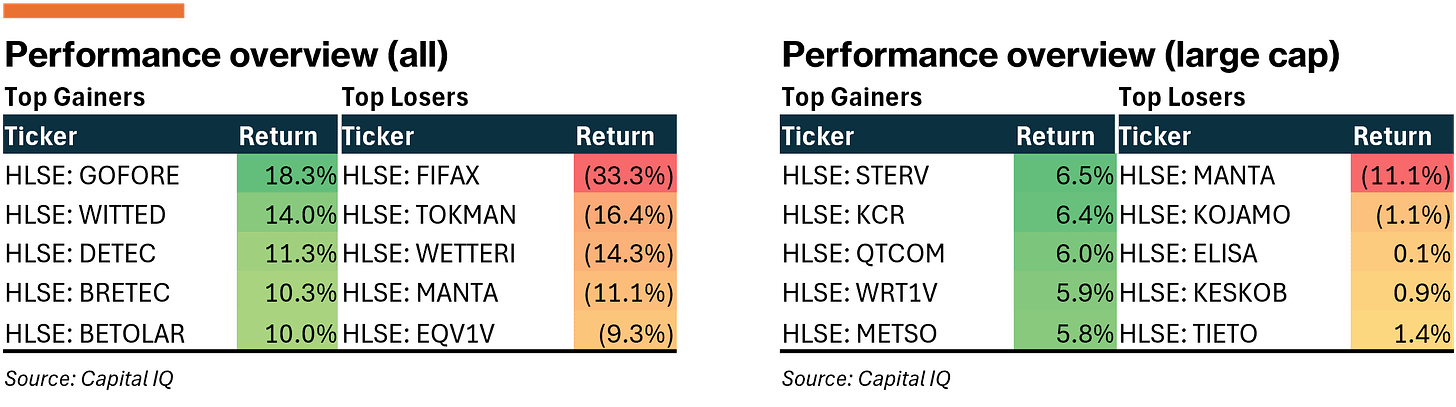

The Nordic all-share index ended the week +2.6% higher, aided by strong returns in logistics and industrials.

Denmark

The week featured earnings from heavyweights, which generally tilted in the positive direction. Separately, Vestas (CPSE:VWS) and Ørsted (CPSE:ORSTED) rallied mid-week on the back of softened U.S. policy risks, though the latter faded as the week progressed. The all-share index (+1.3%) and large-cap index (+4.0%) both trended higher.

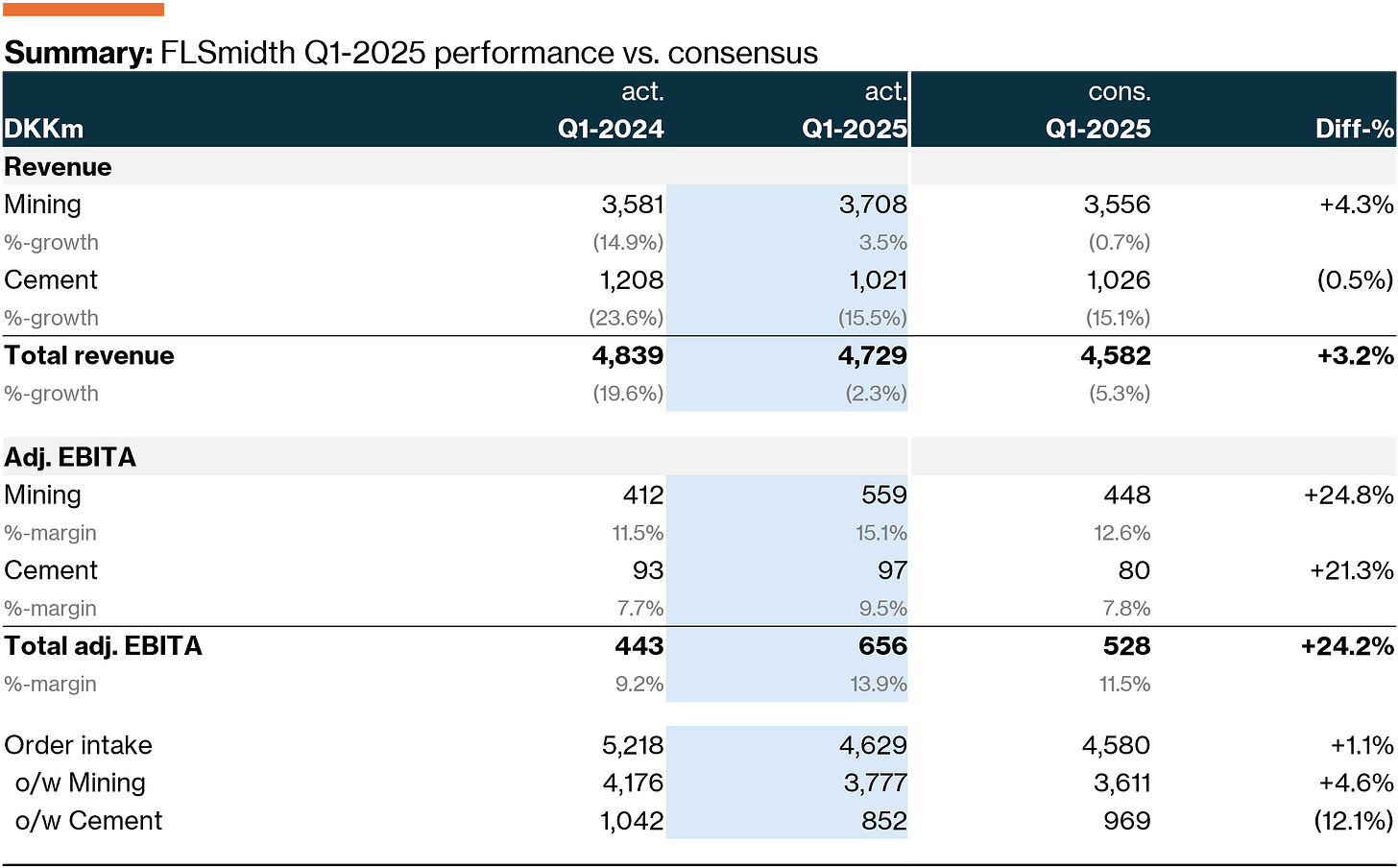

FLSmidth (CPSE:FLS) kicked off 2025 with a strong Q1-2025, delivering broad-based beats and lifting its full-year guidance — a strong signal this early in the year. The company is steadily executing on its transition toward a pure-play mining equipment company, and announced its exclusive talks with Pacific Avenue (PE carve-out specialist) to divest its Cement division — a non-core asset that’s been in limbo for a while.

The core Mining business is executing well. Gross margin reached 35.2% (up 2.3pp YoY), lifted by a 74% service mix and improved utilization. Adj. EBITA came in at 15.1%, 2.5pp above consensus. Orders rose 5% vs. expectations, driven by 25% beat in product orders. High-margin pumps & cyclones grew 10% YoY, with early signs that added sales capacity is converting pipeline to bookings.

Despite clear progress on the company’s self-help story, the stock still trades at a discount to peers. We are generally bullish on the company see the long awaited cement divestment as a catalyst toward closing the underlying valuation gap.

The coming week will feature earnings from Rockwool (CPSE:ROCK B), H+H International (CPSE:HH), United International Enterprises (CPSE:UIE) Matas (CPSE:MATAS), among other.

Earnings review & relevant news

Novo Nordisk (CPSE:NOVO B) announced the departure of CEO Lars Fruergaard Jørgensen. The decision follows a period of mixed communication on scripts, fiercer competition, and several senior leadership exits.

Nordea (CPSE:NDA DK) is now on trial for alleged breaches of anti-money laundering laws tied to ~DKK 26bn in transactions for large Russian clients between 2012 and 2015. The bank has pleaded not guilty. While the charges have been known for some time, the trial marks a new phase — and revives headline risk just as investor focus was turning back to capital returns.

Per Aarsleff (CPSE:PAAL B) upgraded its FY2024/25 guidance ahead of the H1 report scheduled for May 28. Revenue is now expected at DKK 22–23bn (prev. DKK 21.7–22.8bn), and EBIT at DKK 1,100–1,200m (prev. DKK 1,050–1,150m).

RTX (CPSE:RTX) delivered strong Q2-2024/25 results with revenue up 25% YoY (CC) to DKK 160m, driven by Enterprise (+39%) and Healthcare (+582%), while ProAudio declined 50%. EBITDA reached DKK 17m, supported by mix and margin improvement (gross margin 49.7%). FCF was DKK 28m, net cash rose to DKK 108m. FY guidance was reiterated, though H2 is expected to retract 11–21% on tariffs and limited order visibility.

Lundbeck (CPSE:HLUN) reported Q1-2025 revenue of DKK 6,235m (vs. DKK 5,786m cons.), up 18% YoY (16% LCY) and 8% ahead of consensus. Adj. EBITDA came in at DKK 2,173m (vs. DKK 1,790m cons.), up 24% YoY and 21% above expectations. EBIT beat by 33%. Strategic brands rose 28% YoY to DKK 4,801m (24% LCY), with all products exceeding expectations. FY2025 guidance was raised: revenue growth now 8–11% LCY (prev. 7–10%) and adj. EBITDA growth 8–14% LCY (prev. 5–11%). With current momentum, the company appears on track to reach the upper end of the range.

Sweden

Stockholm featured some large moves in both directions, but heavyweights pulled the indices clearly into positive territory. The all-share index (+3.3%) and large cap index (+3.9%) moved in lockstep, both of which are now back in green territory on a YTD basis.

NIBE (OM: NIBE B) delivered a decent Q1-2025, showing clear signs of operational stabilization, with organic growth finally turning positive and profitability improving across key segments. Group sales rose +2% YoY (1.8% organic), with Climate Solutions leading the charge growing ~3% organically on strong momentum in the Nordics and Germany (+35% YoY).

Gross margin expanded, supported by a better product mix and normalized inventory levels across the channel. EBIT rose 52% YoY, beating consensus by 3%, with Climate Solutions delivering a 9.2% EBIT margin — up 20bp YoY. Elements came in 4% above expectations, while Stoves underwhelmed. Cash generation was held back by sizeable NWC build-up. The company currently trades at ~30x fwd EV/EBIT — a premium to peers, but arguably with better earnings visibility.

In the coming week, we anticipate earnings from Bioarctic (OM:BIOA B), Better Collective (OM:BETCO), Embracer Group (OM:EMBRAC B).

Earnings review & relevant news

SBB (OM:SBB) rallied after securing a new anchor shareholder — Aker, controlled by Norwegian billionaire Kjell Inge Røkke — who acquired a 9.1% stake via a directed issue of 164m class B shares. In parallel, PPI (SBB-controlled) is acquiring a NOK 2.3bn property portfolio from Røkke’s TRG, paid via newly issued PPI shares. SBB will subscribe to ~40m of those shares by issuing more of its own stock. The two-step deal improves SBB’s LTV and cash flow optics — but also further blurs the lines between buyer, seller, and capital provider. SBB remains the most shorted stock in Sweden (13.4% SI).

Storytel (OM:STORY B) unveiled new 2028 financial targets at its CMD: >10% annual revenue growth (CER), >20% EBITDA margin, and net debt/EBITDA below 1.5x. 2025 guidance includes 7–10% growth, 17.5–19.0% EBITDA margin, and 10% subscriber growth, with capex <5% of revenue. The strategy leans on deeper penetration in core markets and M&A in publishing and streaming.

Bactiguard (OM:BACTI) spiked 30% midweek without any disclosed news. The rally triggered take-private speculation, driven by a shareholder base featuring EQT’s Thomas von Koch, Jan Ståhlberg, and former CEO Christian Kinch.

Asker Healthcare (OM:ASKER) delivered a strong debut Q1-2025 report with net sales of SEK 3,995m (vs. SEK 3,899m cons.), up 16% YoY (6% organic). Gross profit beat by 8%, lifting gross margin to 40.8% (+210bp YoY), driven by mix, purchasing synergies, and the HSL acquisition. Adj. EBITA came in at SEK 364m (vs. SEK 354m cons.), up 17% YoY, with a stable EBITA margin of 9.1% (flat vs. cons., +10bp YoY). Segment performance was solid across the board, led by the West region (+9% sales growth, +100bp margin). Management reaffirmed its 20% FY EBITA growth ambition, supported by M&A tailwinds, procurement gains, and resilient opex-driven demand.

Karnov Group (OM:KAR) reported Q1-2025 revenue of SEK 673m (vs. SEK 670m cons.), up 6.5% YoY (2.7% organic). Adj. EBITA was SEK 175m (vs. SEK 180m cons.), with margin expanding 3.3pp YoY to 26.0% (vs. 26.5% cons.). Region North stood out with 15% growth (8% organic) and a 47% margin, supported by strong online sales and AI monetization. Region South underperformed, with organic sales down 1.6%, due to weaker offline demand in Spain. France tracked in line with the group’s 4–6% growth target. FCF doubled to SEK 245m and leverage declined to 2.4x. The group reiterated its long-term margin expansion plan and continues to see upside from AI adoption.

Catena Media (OM:CTM) printed Q1-2025 revenue of EUR 9.8m, down 39% YoY, with North America accounting for 89% of group sales. Adj. EBITDA fell 51% to EUR 0.9m (margin 9%), impacted by a shift toward lower-margin subaffiliation and modest cost growth. New depositing customers dropped 50% YoY. Post-quarter, Catena cut ~25% of headcount and deferred hybrid interest payments, targeting EUR 4.5–5.0m in annualised savings. Management remains focused on stabilising North America while building out lifecycle marketing and automation.

Yubico (OM:YUBICO) reported Q1-2025 revenue of SEK 623m, up 25% organically and 2% below consensus. Adj. EBITA margin was 18.3% (flat YoY), in line with expectations. Bookings fell 10% YoY to SEK 524m due to delayed customer orders, though management noted similar softness in Q1-2023 ahead of a strong full-year. ARR rose 25% YoY to SEK 346m.

Finland

Finland followed the footsteps of the wider Nordic markets, with the all-share index (+3.0%) and large-cap index (+3.4%) both ending higher. Gains were broad-based, with +65% of shares ending the week in positive territory. Aside from earnings, corporate news were limited.

Relais’ (HLSE:RELAIS) Q1-2025 came in slightly better than expected, easing concerns tied to a mild winter and soft demand in parts of the Nordics. Revenue was flat YoY at EUR 83m (in line with cons.), while gross margin expanded +3pp YoY to 49.6%, aided by mix and efficiency gains in core segments. Adj. EBITA of EUR 9.2m beat estimates by 7%, supported by strength in Spare Parts & Lighting and an improving online channel in Finland.

While the Equipment segment was hit by unseasonal weather, management reiterated confidence in a “normal” 2025. The two bolt-on acquisitions announced post-Q1 — Team Verksted (Norway) and Matro Group (Belgium) — should lift 2025E EBITA by ~24%, bringing the company closer to its EUR 50m 2025 target. Leverage remains elevated (2.7x net debt/EBITDA), and further M&A may prompt balance sheet action near term.

With most of the earnings season having come to an end, next week will be less busy with fresh figures from the likes of Wetteri (HLSE:WETTERI) and Musti Group (HLSE:MUSTI).

Earnings review & relevant news

Mandatum (HLSE:MANTA) paid its mega-dividend of EUR 0.66/share. Hence, the drop for the week was largely mechanical in nature.

Marimekko (HLSE:MEKKO) reported Q1-2025 revenue of EUR 39.6m (vs. EUR 38.3m cons.), up 5% YoY, driven by 14% growth in international sales — particularly strong wholesale in Europe and retail in Finland. Comparable EBIT was EUR 4.4m (vs. EUR 4.6m cons.), with margin at 11.1% (13.8% LY). Profitability was impacted by higher discounts, lower licensing income, and increased fixed costs. Guidance for 2025 was maintained.

Kamux (HLSE:KAMUX) delivered Q1-2025 revenue of EUR 232.6m (vs. EUR 230.1m cons.), down 3.4% YoY, with adj. EBIT at EUR -1.9m (vs. EUR 0.5m cons.). The number of cars sold declined by 8.9% YoY to 14,694 units. Gross profit per car decreased by 18% YoY to EUR 1,233, impacted by suboptimal inventory and intensified competition. While revenue in Finland grew by 2.3% to EUR 176.1m, adj. EBIT fell to EUR 2.6m (vs. EUR 4.9m cons.). Sweden and Germany remained loss-making, with revenues declining by 39.6% and 10.2%, respectively. Despite this, Kamux maintained its FY2025 guidance, expecting adj. EBIT to improve from the previous year.

Raisio (HLSE:RAIVV) reported Q1-2025 revenue of EUR 57.8m (vs. EUR 57.9m cons.), up 4.2% YoY, driven by strong growth in branded products and high-margin oat exports. Comparable EBIT came in at EUR 6.1m (vs. EUR 5.1m cons.), with margin rising to 10.6% (vs. 8.8% cons.), supported by a favorable mix and improved plant utilization. The company reaffirmed its 2025 guidance of delivering EBIT ahead of 2024 levels (EUR 23.4m).

Norway

In Norway, cyclicals dominated the top of the table on the back of optimism about a resumption of global trade. The all-share index (+4.0%) and large-cap index (+4.2%) marched forward, closing the week at new all-time highs.

Mowi’s (OB:MOWI) Q1-2025 landed as expected, with headline figures pre-announced in April. Harvest volumes totaled 108kt, revenue stood at EUR 1,355m (in line with cons.), and operational EBIT was EUR 214m. The 2025 volume guidance of 530kt was reiterated, with management stating increased confidence in reaching it — backed by a ~11% YoY increase in biomass.

Blended farming cost improved to EUR 5.89/kg (vs. EUR 6.05/kg LY), supported by better biology and scale. Further cost reductions are expected in H2-2025 on higher volumes and lower feed prices. Notably, the company continues to guide conservatively relative to peers. We note the company trades at a slight discount to SalMar (reporting next week) despite being more diversified and delivering steadier execution.

Next week be relatively busy with earnings from Bakkafrost (OB:BAKKA), SalMar (OB:SALM), Bouvet (OB:BOUV), Golden Ocean Group (OB:GOG), Frontline (OB:FRO), among other.

Earnings review & relevant news

Norwegian (OB:NAS) announced the redemption of two convertible loans and two PIK bonds issued in 2021. As part of the process, the Norwegian state — a holder of one of the convertibles — will become a shareholder with a 6.37% stake. The move simplifies the capital structure and formalizes the state's equity position following its pandemic-era support.

BEWI (OB:BEWI) reported Q1-2025 revenue of EUR 188m (+2% YoY) and adj. EBITDA of EUR 15.0m (+13%). Insulation led the way with EBITDA up 21% to EUR 7.9m amid rising construction activity — marking the second consecutive quarter of volume growth. Packaging held steady with EBITDA of EUR 9.4m. Earlier this year, the company announced its agreement to merge its raw materials unit with Unipol (unlocking up to EUR 75m in cash) and divesting parts of its food packaging business for EUR 20m.

Norbit (OB:NORBT) delivered Q1-2025 revenue of NOK 522m, up 29% YoY, with EBIT of NOK 127.4m (margin 24%). EPS rose to NOK 1.40 (vs. NOK 0.50 LY). The Ocean division delivered its second-best quarter ever, with revenue up 92% YoY to NOK 233m and a 35% EBIT margin. Connectivity was stable YoY at NOK 146m (28% margin), while PIR grew 11% to NOK 161m (14% margin). Management reaffirmed the 2025 revenue target of NOK 2.2–2.3bn.

Lerøy Seafood (OB:LSG) reported Q1-2025 operational EBIT of NOK 1,049m, in line with company expectations but slightly below consensus. EBIT/kg for farming (ex. wild catch) came in at NOK 26.2. Guidance for 2025 harvest volumes (200kt in Norway, 16kt in Scottish Seafarms) was reiterated, and costs are expected to trend lower YoY. Impacts from U.S. tariffs and Norway’s licensing changes remains immaterial for now.

Multiconsult (OB:MULTI) reported Q1-2025 EBITA of NOK 190m (vs. NOK 219m cons.), with the miss driven by a lower billing ratio (72.1% vs. 73.3% cons.) and NOK 9m in legal write-downs. EPS came in at NOK 4.86 (vs. NOK 5.79 cons.). Order intake of NOK 1.7bn was +6% vs. cons., but the backlog declined 6.6% YoY to NOK 4.7bn. The company maintained a stable outlook but flagged continued weakness in real estate.

Great work with these weekly summaries! Thank you!