While the wider European stock market (STOXX Europe 600) ended the week at a record peak, the Nordic stock market concluded the week with modest gains (+1.1%) -- and still below its MA50 level. It seems as though investors are grappled with two diverging themes, notably the unpredictable repercussions from the new US administration amid otherwise resilient earnings coming out of the region.

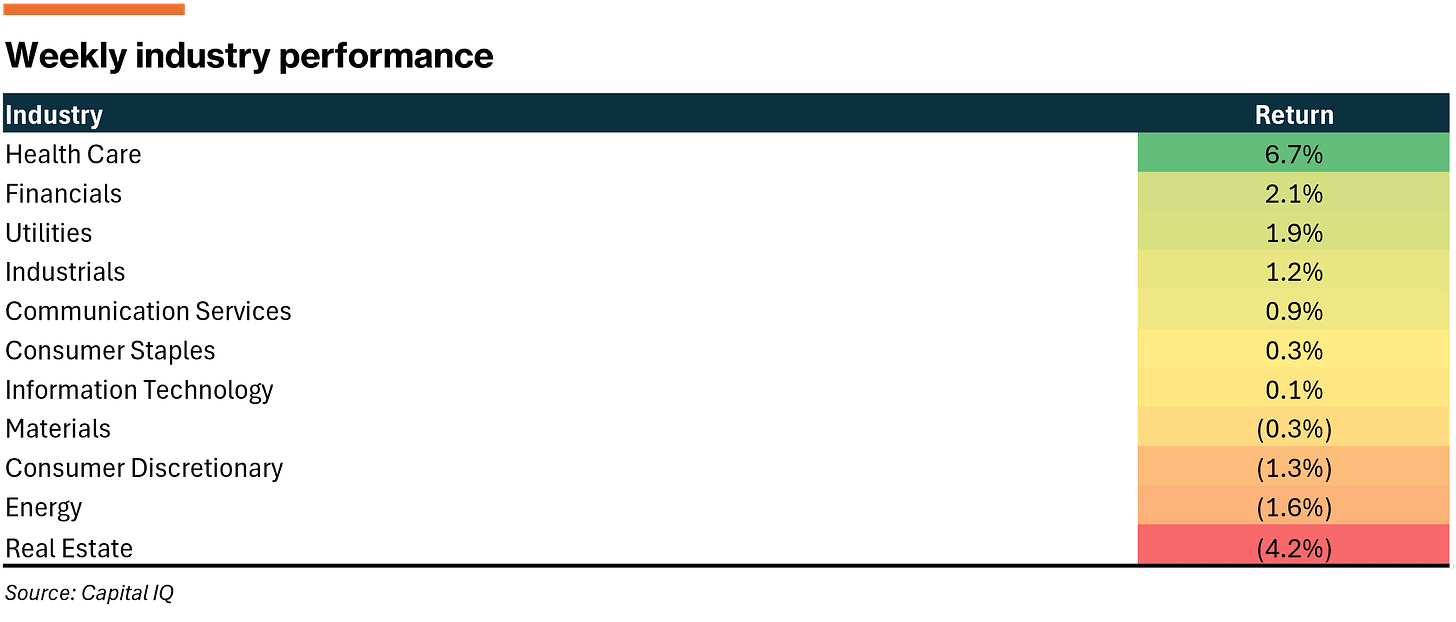

From an industry perspective, markets were aided by a solid performance in Health Care (+6.7%) with names like BioArctic (+16.8%) and Novo Nordisk (+13.0%) showing great strength. In the other end of the spectrum, Real Estate (-4.2%) has dragged on wider market performance with most (+80%) companies ending the week in red.

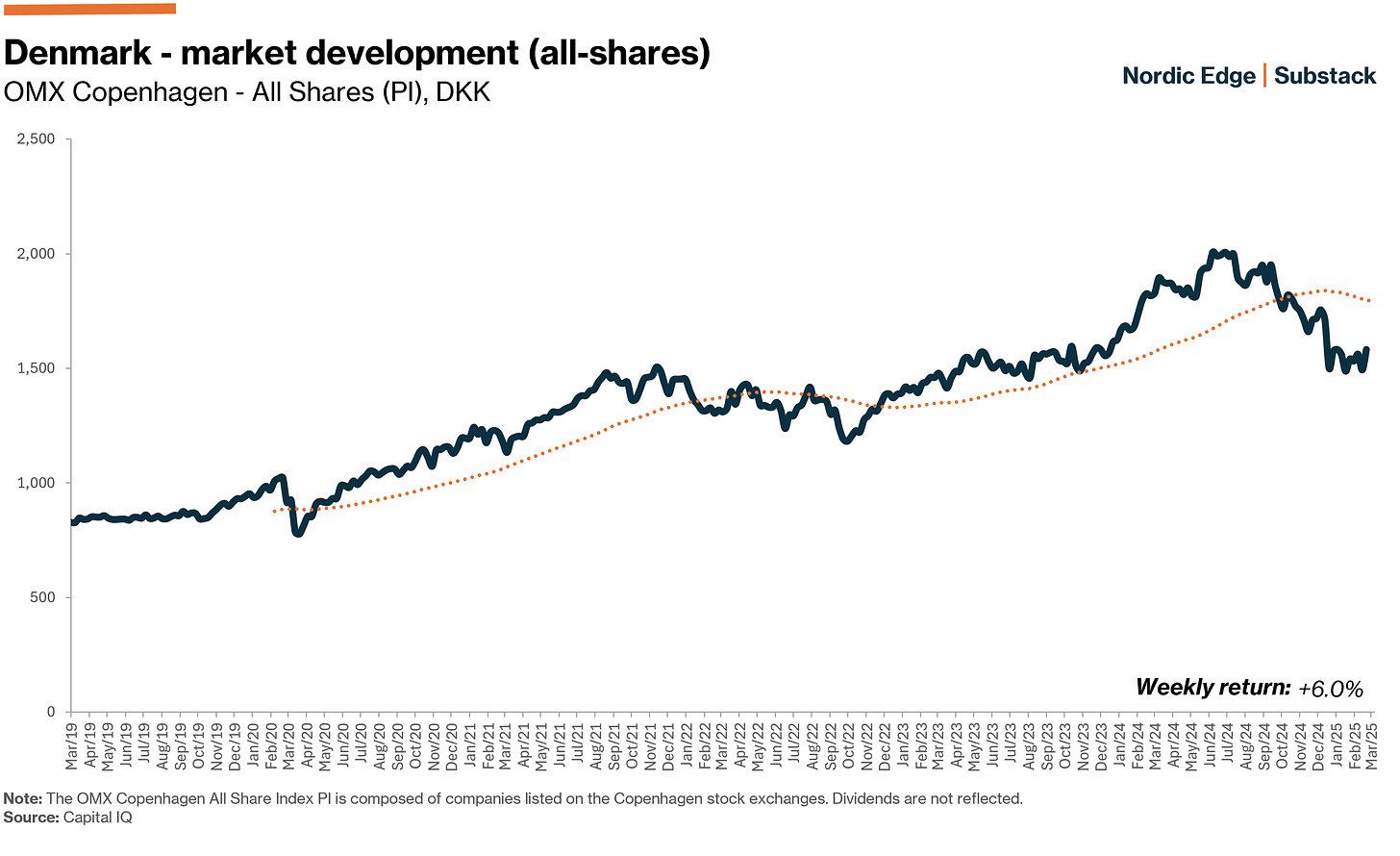

Denmark

The Danish market was the clear standout this week, with the all-share index (+6.0%) and large-cap index (+2.3%) climbing on the back of strong earnings and selective reversals in sentiment.

ISS (+14.7%) saw a sharp move higher following strong FY2024A results; and likely exacerbated by short-covering, as it remains one of the most shorted stocks in Denmark (SI: 7.57%). The company reported organic growth of 6.3% for the year, primarily driven by price increases and positive volume growth, with an EBIT margins of 5.0%. FCF reached DKK 2.0bn , despite a DKK 600m impact from withheld payments related to an ongoing dispute with Deutsche Telekom. We are particularly excited about management’s decision to distribute excess cash to shareholders by way of a DKK 0.6bn dividend and 2.5bn share repurchase program; a shift away from its legacy non-accretive M&A.

Novo Nordisk (+13.0%) similarly rebounded after recent share price pressure brought by intensified competition (and failing to deliver on expected efficacy for new drugs) within weight-loss medication.

In the small-cap arena, Asetek (+48.2%) experienced a sharp two-day rally with no clear catalyst. On the downside, CBrain (-30.1%) and Rovsing (-15.3%) struggled following disappointing earnings.

For the coming week, we keep an eye on Royal Unibrew (CPSE: RBREW), which has been riding the momentum of Carlsberg following its strong guidance for 2025. Similarly, A&O Johansen (CPSE: AOJ B) warrants attention as domestic building activity shows a modest rebound, though we anticipate management will remain cautious in its outlook for the coming year.

Other relevant news from Denmark:

Danish GDP grew +3.4% in 2024, mainly driven by the Pharmaceutical industry (read: Novo Nordisk)

Denmark-based asset manager BLS Capital announced its +15% stake in Better Collective; a strong signal following deteriorating sentiment

Sweden

Swedish market performance was defined by sharp divergences, with strength in select names offset by weakness elsewhere. The all-share index closed the week slightly lower (-0.7%), while large-cap stocks managed to hold just above breakeven (+0.3%).

We flagged both Viaplay (OM: VPLAY B) and SBB (OM: SBB) as interesting names ahead of earnings releases this week, which proved to be a good call..

Shares in Viaplay surged (+36.7%) as management reinforced confidence in the ongoing turnaround, reiterating its 2025 guidance for MSD organic topline growth and positive FCF for core operations. The company delivered ~5% YoY organic sales growth, largely price/mix-driven, though volumes remained under pressure, with a sequential subscriber decline (-1.8%). While the market remains skeptical, the latest results provide a constructive data point in the broader equity story. Execution will be key; we see a pivot in subscriber growth as a catalyst for a substantial near-term re-rating, yet emphasize that the valuation still warrants a discount to the wider peer group.

Real estate player SBB tumbled (-21.2%) as investor confidence remained fragile despite management’s ongoing deleveraging efforts. The company continues to prioritize asset divestitures, targeting SEK 10 billion in sales, yet concerns persist over its ability to execute at favorable valuations in a still-challenging real estate market. The withdrawal of legal proceedings by U.S. hedge fund Fir Tree Partners provided some relief, but it has done little to offset broader skepticism around the company’s capital structure and long-term viability.

With +20 companies releasing earnings/annual reports for the coming weeks, investors have enough to digest. We look forward to read the 2024 annual report from Volvo on the back of its recent announcement to distribute 62.7% of its stake (SEK 9.5bn) in electric vehicle manufacturer Polestar Automotive Holding to its shareholders.

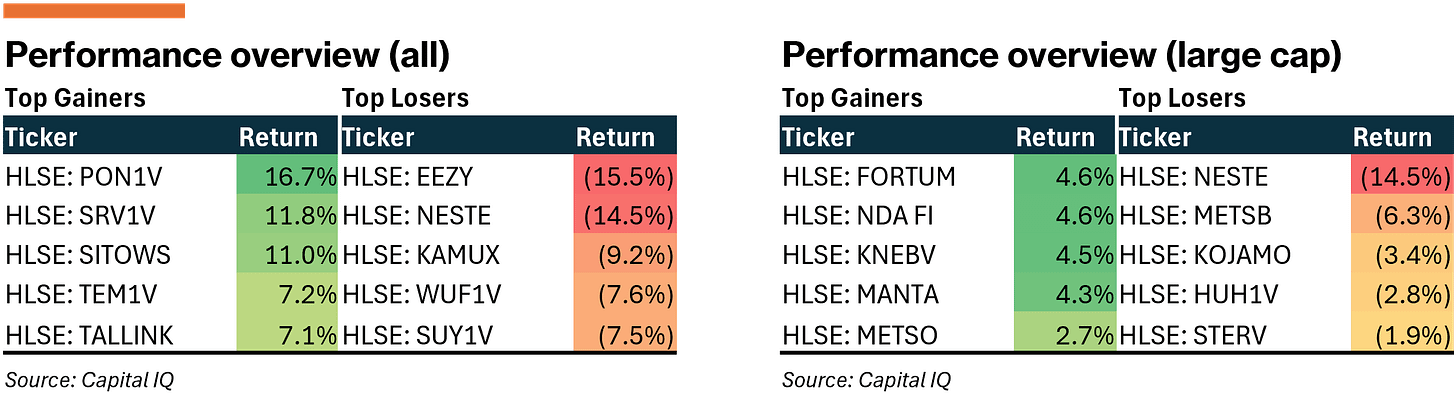

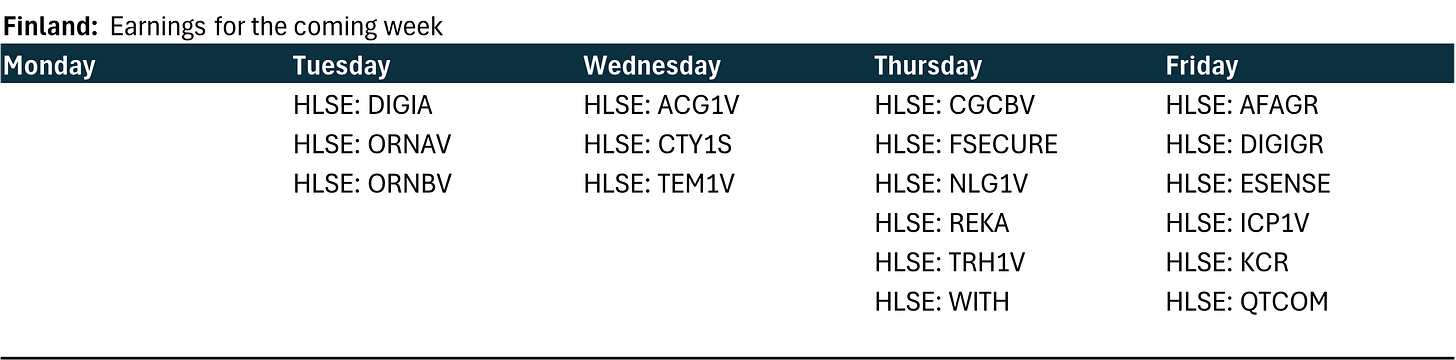

Finland

Momentum since the turn of the year continued in the past week, albeit at a slower pace, with the Finnish all-share index closing the week on a positive streak (+1.1%).

Ponsse Oyj (+16.7%) was the top performer following better-than-feared earnings guidance for 2025 amid otherwise challenged end-markets. While FY2024A sales landed ~9.4% YoY lower on topline level with EBIT margin contraction of 0.8pp to 4.9%, cash flows have been aided by adequate working capital management. Investor confidence was further supported by management’s focus on operational efficiency and cost control.

In contrary, Neste's shares experienced a significant decline (-14.5%) this week. The world's largest producer of sustainable fuels announced substantial cost-cutting measures, including a 10% reduction in its workforce, following a challenging year. CEO Heikki Malinen cited slower-than-expected growth in the green energy market, exacerbated by global events such as the war in Ukraine and inflation spikes. Despite the setbacks, Malinen expressed optimism about the future of sustainable aviation fuel (SAF) and emphasized the need for more predictable public policies to stabilize the market. The +75% of its market cap has been erased L5Y and the company currently trades at ~7x fwd EV/EBITDA against an average of ~11.5x during the same timeframe.

Norway

The Norwegian market - as the only market in the Nordics has consistently traded above its MA50 level since mid-2023. Past week as no different with the all-share index gaining a modest +0.9%.

Zaptec (+28.2%) reported earnings on Wednesday, and despite sequential declines on topline of -19.9% in Q4-2025, the company showcased EBIT in positive territory (NOK 8.4m); a significant turnaround from the previous year's loss-making trend. Additionally, we note the pivot in order intake as comforting going into 2025.

Similarly, Kongsberg (+16.2%) edged higher in line with the wider Defense sector in the wake of continued talks of higher military spending. The company still trades at a substantial premium to peers on all metrics.

The Norwegian market is looking into a busy week with lots of new reports coming out.