Monday Morning Espresso - W11'25

The Nordic stock markets concluded the week with performances that echoed the previous week's trends. Investors once again grappled with familiar concerns brought by the Trump administration as tariffs on steel and aluminum imports were announced. The effects were immediate; companies heavily reliant on export markets, especially those with significant U.S. exposure, saw valuations compress as investors recalibrated growth expectations under the weight of geopolitical friction. In contrast, the defense sector maintained its momentum following EU-countries’ commitment to increased defense budgets.

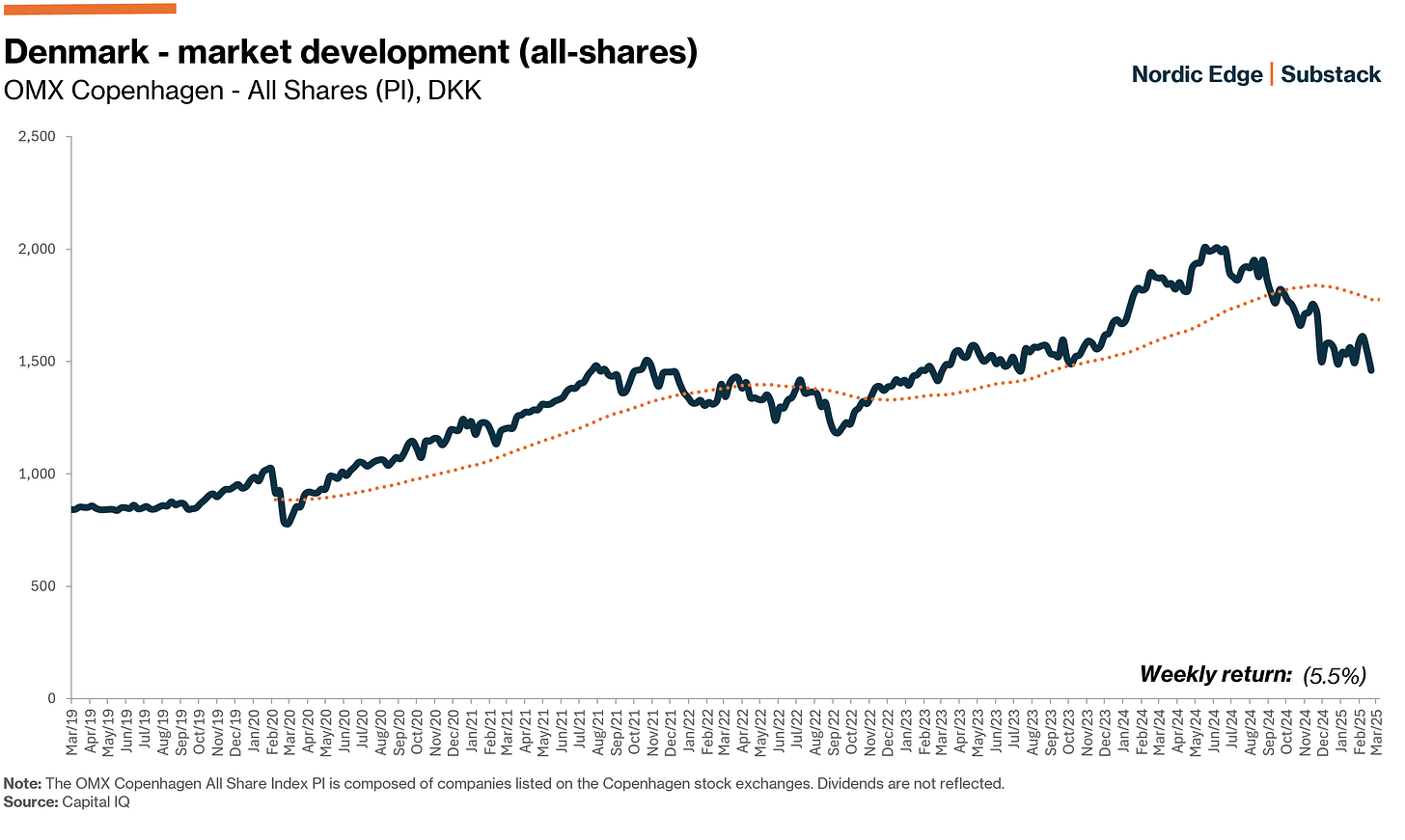

Denmark

The Danish stock market saw a sharp divergence this week, with significant drawdowns in the market's tone-setting large caps. The all-share index tumbled 5.5%, marking its worst weekly performance in over a year, while the large-cap index slid 2.4%.

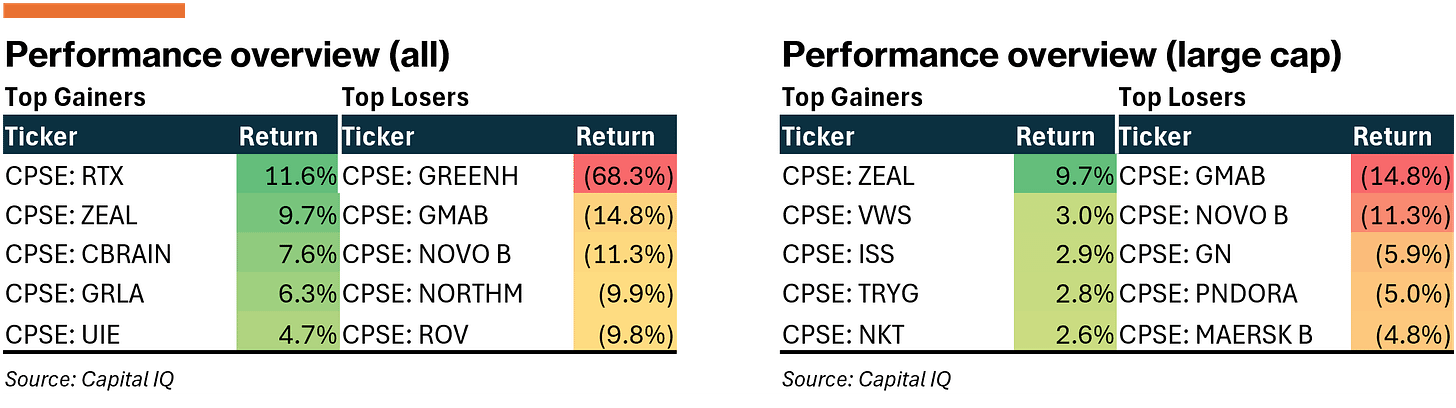

Healthcare heavyweights bore the brunt of the sell-off, as Genmab (CPSE: GMAB), Novo Nordisk (CPSE: NOVO B), and GN (CPSE: GN) extended their steep double-digit declines. In retrospect, the pullback in these high-conviction names may have been overdue, considering their relative outperformance against Nordic peers from 2019 to 2023.

Most movements throughout the week appeared to be systematic. Interestingly, shares in Grønlandsbanken (CPSE: GRLA) surged following Greenland's recent parliamentary elections, where the pro-business Demokraatit party, advocating independence from Denmark (and the US) but maintaining an open stance on trade and investment, secured a decisive victory. The outcome has fueled investor optimism around increased foreign capital inflows, particularly in Greenland’s resource and infrastructure sectors.

While company-specific news were limited this week, it was not all macro-driven. We note specific idiosyncratic drivers for the week, including:

Novo Nordisk (CPSE: NOVO B) sell-off came after releasing disappointing trial results for its new weight-loss drug, CagriSema. The treatment helped obese or overweight Type 2 diabetics lose an average of 15.7% of their weight in a late-stage trial, falling short of the anticipated 25%.

Green Hydrogen (CPSE: GREENH) filed for in-court restructuring to address the company's financial challenges and to facilitate a structured reorganization of its operations. Its collapse follows a series of financial setbacks, including an unsuccessful attempt to raise at least DKK 300 million through a rights issue.

RTX (CPSE: RTX) surged after Polaris, a Danish private equity firm, disclosed a 7% stake in the struggling wireless communication company. RTX has faced declining sales and a steep stock drop in recent years, but Polaris sees potential in its technology and plans to work closely with management to drive a turnaround. RTX projects FY2024/25 revenues of DKK 490m-520m and an EBITDA range of DKK 0-20m.

Zealand Pharma (CPSE: ZEAL) rallied after securing a USD 5.3bn partnership with Swiss pharmaceutical giant, Roche, to develop and market its obesity drug candidate, petrelintide, in the US and EU. The agreement includes an initial payment of $1.4 billion, with additional milestone payments tied to regulatory and commercial success. The collaboration also involves developing a combination therapy with Roche’s CT-388, reinforcing Zealand’s position in the weight-loss drug market. Subject to regulatory approvals, the deal is expected to close in Q2-2025.

Sweden

Despite a seemingly muted performance, with the all-share index slipping 1.4% and the large-cap index down 1.7%, activity in the Swedish market remained as dynamic as ever. The week featured notable developments, including the IPO of Röko (OM: ROKO B) and a take-private offer for Norva24 (OM: NORVA), underscoring continued investor interest despite broader market softness.

At the top of the week's performers, Norva24 (OM: NORVA) surged 57.2% after accepting a cash offer from global private equity firm Apax, valuing the company at SEK 6.63bn. A key player in Europe’s underground infrastructure maintenance (UIM) industry, Norva24 has been at the center of a consolidation strategy first led by Valedo, which took the company public in 2021. The independent bid committee of the board unanimously recommended the offer, with 57% of shareholders, including key investor Valedo, agreeing to sell their shares. Pending regulatory and customary approvals, the transaction is expected to close in Q2-2025.

In the large-cap sphere, H&M (-7.4%) slid as global peer, Inditex - the owner of Zara - delivered a softer-than-expected figures for 2024A. The read-across was swift: H&M shares retracted, as investors reassessed the sector’s pricing power and post-pandemic tailwinds. H&M has been struggling to compete against rivals like Inditex-owned Zara, as well as lower-cost fast fashion players such as Shein. With its Q1-2025 earnings due on March 27, the market has made its early judgment.

Other relevant news from the week happening under the radar, include:

CVC Capital has offloaded 22.5m shares in Synsam (OM: SYNSAM), representing 15% of the capital and votes, at SEK 41.00/share - a 6.7% discount to the prior-day closing price of SEK 43.95. Following the transaction, Theia Holdings (CVC’s investment vehicle) retains 16.3% ownership. The sponsor - which led Synsam’s IPO in 2021 - has gradually reduced its stake, most recently selling 14% in March 2024. With this trajectory, we expect the remaining block to be offloaded in the coming 6-12 months

Röko (OM: ROKO B), a serial acquirer of small and mid-sized businesses, completed its Nasdaq Stockholm debut at a market cap of SEK 29.9bn. Röko has built its model around patient capital and perpetual ownership, holding 28 companies across Europe with a focus on stable, cash-generating companies. The Group generated SEK 6.2bn in revenue and SEK 1.7bn in adj. EBITA in 2024.

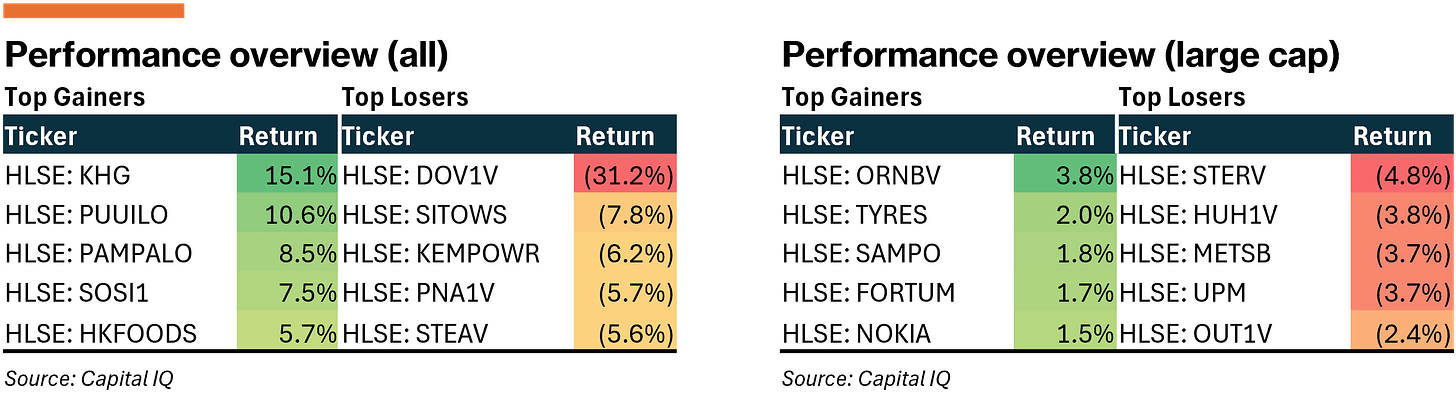

Finland

Finland’s stock market navigated a tug-of-war between encouraging local fundamentals (very low inflation and company-specific strengths) and external headwinds (trade jitters and global volatility). Equity market saw choppy trading through the week, ultimately ending roughly flat to slightly lower for both the all-share index (-0.4%) and large-cap index (-0.5%).

Despite macroeconomic headwinds, select Finnish stocks found traction. KH Group (HLSE: KHG) +15.1% after announcing a sale process for Indoor Group (58.3% owned). Puuilo (HLSE: PUUILO) surprised investors with 2024 sales of EUR 383.4m and adj. EBITDA of EUR 67.0m (17.5% margin), exceeding its EUR 60-66m guidance.

In the large-cap space, Orion Oyj (HLSE: ORNBV) climbed toward record highs following news of a strategic expansion, reinforcing its growth trajectory.

In other news, Infrastructure builder GRK Infra is heading to the public markets with a planned EUR 30m share issue, alongside existing shareholder sales. Anchor investors, including Varma Mutual Pension Insurance and Elo Mutual Pension Insurance, have committed EUR 36m, contingent on a pre-money valuation cap of EUR380.4m. The proceeds will fund machinery investments and workforce expansion, aligning with GRK’s growth strategy. In 2023, the company posted EUR 546.2m in revenue and EUR 38m in adjusted EBITDA, reinforcing its position in Finland, Sweden, and Estonia’s infrastructure sector.

Norway

The Norwegian market saw volatile trading with the index dipping through Wednesday amid global trade-war jitters, then rallied on Thursday and Friday despite negative international news flow. The all-share index (+1.1%) and large-cap index (+0.8%) ended the week higher.

During the week, NEL (OB: NEL) rallied +41.1% after Samsung entered as a major shareholder (9.1% ownership) and strategic partner. The “strategic alliance” comes on the back of otherwise industry-wide negative sentiment about green hydrogen.

“SAMSUNG E&A will provide integrated electrolyser solutions with competitive value and bankability to green hydrogen project owners with Nel. Green hydrogen is a core technology in clean tech with carbon-neutral technologies and has a high value not only as itself but also as a basic ingredient for green ammonia, green methanol, SAF, and e-fuel. Nel is a market-leading electrolyser company and the only company that has competitive technology in both Alkaline and Proton Exchange Membrane electrolyser with a 100-year history. We are very glad to announce our partnership with Nel”

- Hong Namkoong, CEO of SAMSUNG E&A

While the Samsung investment may convey a level of confidence, we remain reserved on the name and wider industry until financial viability (i.e. profitability) is evidenced.

Golden Ocean Group (OB: GOGL) plunged -15.6% over the week following continued uncertainty introduced by the U.S. administration. Negative sentiment was exacerbated by the news of major shareholder (John Fredriksen) selling his stake (40.8%) to Belgium’s CMB.TECH, fueling speculation of a take-over.

Idex Biometrics (OB: IDEX) collapsed 57% after the firm announced a CEO replacement and an emergency loan financing that could heavily dilute equity. The fingerprint sensor maker has seen lumpy performance for +10 years with no positive cash flows during the same timeframe.

HAV Group (OB: HAV) soared ~26% after the maritime technology provider surprised to the upside with fourth-quarter results showing a a return to black numbers and a doubling of its order book.